Do I play with custom, self-branded golf tees with cheesy slogans on them?

Yes, I do.

Markets reacted poorly to news out of Greece today. The country’s financial struggle has essentially been a practical joke for five years. Thankfully, the details don’t really matter to your portfolio.

Just like the details don’t matter when conflict in the Middle East flares up, as it perpetually does. Just like they don’t matter when other small countries get into trouble and the dreaded “d” word comes into play (default). Just like they don’t matter when a new disease shows promise of ravaging the entire world (but never does).

Show me a globe and a blindfold and wherever I lay a finger on land will reveal a country whose drama has roiled markets at one point in history. Today, it’s Greece. Next year it’ll be somewhere else.

The only thing that matters is perspective. If your portfolio’s value declined today then it’s important to thank Greece and the investors who panicked because they are serving as a reminder that patience and tolerating risk will forever be rewarded. The practice of giving no incentive to acting on impulse is the basis for the entire financial system – it creates the risk premium, in finance-speak – and by embracing this effect you will ensure yourself an advantage over everyone who acts on emotion.

Risk is rewarded. Patience is rewarded. Impulse is not.

Markets were down about two percent today and it’s something that will happen every so often through the course of any given year. If you lost “a lot” of money today then I suggest you thank Greece – the country’s drama show has served a reminder that you started today with a lot of money and you have ended the day, still, with a lot of money. It’s never bad to be reminded of a good thing.

Keep ignoring the headlines and keep your eyes on the target, soon enough you’ll be thanking yourself (maybe from a Greek island you purchased on Craigslist for twenty bucks).

Life is 10% what happens to you and 90% how you react to it.

-Charles R. Swindoll

I’m a huge fan of golf. It’s about the only stereotypical “financial professional” trait I have. I don’t sport a suit, I’ve never earned a commission and, hell, I don’t even have an office – but I do love me some golf.

Last weekend, the USGA brought our nation’s championship, the US Open, to the Pacific Northwest at Chambers Bay in Pierce County. This is like having your town host the Super Bowl so naturally I had to be there for at least one day. I was in full-on, giddy golf nerd mode. (Pictures at the bottom of this post!)

The big story out of the weekend was not so much about how the winner (Jordan Spieth!) played, but how the runner-up, Dustin Johnson, lost.

Johnson has a well-publicized problem with closing out tournaments. He’s got one of the most powerful swings in the game and always seems to be at the top of the leaderboard in every tournament he plays, but the guy just can’t close. This weekend was no different, except for the absolute brutal sequence of events.

Dustin choked in epic fashion.

He needed to make a twelve foot putt to win, or he could sink it in two putts to force a playoff. Even so, he three-putted, missing a three footer on his second putt. The color drained from his face and you couldn’t help but feel bad for the guy. Jordan Spieth was practically speechless, no doubt because he felt so bad for Dustin. Three-putting from twelve feet is something you’d expect to see a pro do once a year at very most – but Dustin did it to lose the US Open.

The US Open is the tournament you dream about winning as a kid. Dustin played 71 holes of excellent golf, not to mention a lifetime of preparation, only to let it slip away on the 72nd hole at Chambers. Demoralizing is an understatement.

So where’s the financial parallel?

You’re going to have a Dustin Johnson Moment in your portfolio. I can’t say when, but it’s coming. Tomorrow is one day closer to the next bear market and there’s a very good chance you’ll have a moment where you, too, feel demoralized.

There’s going to be a day, or a week, month or year, where it all just goes wrong. A good many folks had a “DJ Moment” in 2008 – financial markets were crashing and investors were similarly dejected after seeing their portfolios take haircuts of 50% or more. DJ Moment symptoms include loss of appetite, sleep disruption, nausea and/or extreme anger.

Many investors took to liquidating their portfolios in response to their financial DJ Moment – an action nearly all surely regret.

Missed 3-footer at the US Open and halved portfolio alike, it’s all about what you do after your DJ Moment. For Dustin, he’ll either use this golf tournament as a learning experience or it’ll mark the beginning of a steep decline into irrelevance with a significant haircut in earnings.

If Dustin uses this loss to improve his resilience and strengthen his resolve, then he’ll be much better off for it. Dustin could use this loss to springboard himself to major tournament victories.

The financial case is exactly the same: when the next bear market hits, investors will either panic and damage their financial outlook, or they will use the volatility and depressed prices to their advantage. Reiterating a commitment to a long-term focus, where short-term disruptions are barely meaningful, is a must when the next downturn arrives.

How will you know a DJ Moment is present, besides the symptoms listed above? The number one indicator is likely the desire to act. I can tell you, with a high degree of confidence, that the biggest obstacle between you and your goals is you “doing stuff” – especially in response to market selloffs. Financial returns and frequency of “tinkering” have almost a perfectly negative correlation. This effect is known as the Behavior Gap.

Translation: do less to earn more, especially in the face of feeling stress about losses. We need to accept that downturns are always a day closer but are a normal part of markets (just as losing is a part of golf). If we notice a DJ Moment developing, the best course of action is always to take a step back, remove our finger from the “panic” button and head to the practice green to work on our three foot putts.

Now, a few more pictures from the tournament:

Like reading long pieces about interest rates? This one’s for you!

Don’t worry, there’s also discussion of fugitives with bazookas, the danger of steamrollers and the nuances of fire starting.

Read it for yourself:

[gview file=”https://aldercovecapital.com/wp-content/uploads/2015/04/ClientLetterQ12015.pdf” save=”1″]

Financial planning and portfolio management is ripe for disruption, and the “robo” advisors are definitely making inroads. I follow the developments pretty closely and have formed some pretty strong opinions about them. For the most part, they get it – it’s just that there are a few sticking points I believe they’ll need to address to be successful. Obviously it doesn’t benefit me to spell it out for them step by step, but I also know they’re probably not reading this.

One of my gripes is the Schwab cash issue. It’s probably above gripe status – I think they’re acting like full on Wolves of Wall Street on that one. Anyway, on to the point.

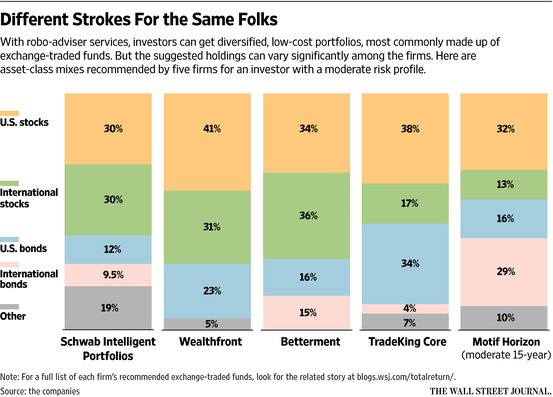

The Wall Street Journal has a great piece online, which breaks down the asset allocation suggestions from each robo for a user with a “moderate risk profile.”

Schwab has what I can only describe as a total “Schwabbed” suite of NINETEEN ETFs as an asset allocation recommendation. This is a ridiculous amount of holdings but it’s not even the point of this note. The details do matter and I think the “robos” will have to do a better job at tailoring portfolios according to a user’s full financial picture instead of assuming every user just sends them their entire investable asset base.

Schwab has what I can only describe as a total “Schwabbed” suite of NINETEEN ETFs as an asset allocation recommendation. This is a ridiculous amount of holdings but it’s not even the point of this note. The details do matter and I think the “robos” will have to do a better job at tailoring portfolios according to a user’s full financial picture instead of assuming every user just sends them their entire investable asset base.

For instance, a majority of the “robo” recommendations in the WSJ piece have an allocation for real estate ETFs. One “robo,” Wealthfront, has no real estate holding slated, but instead recommends a slice of commodities, which is a whole other blog post. Betterment shines again in the WSJ survey, omitting both real estate and commodities – I think they’re the mostly likely “robo” to survive, for what that’s worth.

Back to real estate holdings. I find real estate ETFs, which are usually REIT index funds, are typically an unnecessary asset class for most portfolios. If the home ownership rate in the United States is nearly 66%, then why is it prudent to add real estate exposure to client portfolios? I would be curious to hear the “robos'” answer.

It’s pretty safe to assume that the one third of Americans who don’t own a home are also much less likely to have a portfolio of financial assets ready to invest with a “robo.” And just the opposite, the two-thirds of Americans who own a home are very likely to have assets for investment. It’s also very likely that an investor with a home valued at $200K has their net worth WAY “overexposed” to real estate swings if they have a financial portfolio of $200K as well.

So it stands to reason if you have an investment portfolio then you probably don’t need extra exposure to real estate. Why? If we see another crash in housing of, say 20%, then it’s pretty likely your house will also drop somewhere in the neighborhood of 20%. The same goes for rises in price. I don’t think the slightly different risk exposure of a REIT is sufficient to justify the allocation – REITs are going to live and die by the general value of real estate and housing in their markets. The swings in value of an investor’s home will provide sufficient exposure to real estate.

Plenty of Americans have a big fat mortgage with slim-to-no retirement savings – do they really need more exposure to real estate via REIT ETFs when they finally start investing?

The “robos” will have to incorporate these questions into their client onboarding processes if they want to truly claim their investments are suitable for their clients. I’ve checked a few of them out and haven’t seen these questions being asked. I could be wrong, so, please, “robos,” have your human counterparts contact me if you do indeed take home ownership into account for tailored portfolios.