BEC-You’re-Up-to-No-Good

Most Washingtonians know what BECU is. Formerly a credit union with a closed field of membership for Boeing employees only, BECU, now open to the public, is Washington state’s largest credit union at over $20 billion, has more than a million members, and is the 4th-largest credit union nationally. They’re about seven times bigger than the nearest in-state credit union competitor. Coincidentally, they’re headquartered in the same city as this blog, so you can consider this a domestic dispute between neighbors. But enough background, let’s talk about BECU interest rates on deposit accounts.

So, what’s the beef? It’s all about the way the advertise their interest rates. Take a look:

Innocent enough, right?

Wrong.

Seeing that 6.17% interest rate flash on the screen is a show-stopper. The record player screeches to a halt and a burning question flashes on the mind of anyone with a decent handle of current interest rates (or math):

“What the hell?”

This rate is triple anything else considered competitive in the marketplace, which raises all kinds of red flags and trips any bullshit detector that’s even remotely calibrated.

So many things come to mind, but first, here’s the ultimate conclusion: BECU should stop doing this kind of deceptive marketing. It’s Wells Fargo slimy. It’s payday lender garbage. And it’s nice to be innovative, but using teaser rates for deposits is not exactly the kind of innovation I’d recommend.

So what exactly is it that ties together Wells Fargo, payday lenders, and this marketing from BECU? Preying on people who just don’t know any better. People who just aren’t very good at math. Or people who know a little, but not enough to know better. They might know that BECU has a good rep, and that they should be looking for high interest rates – which could be plenty of reason for them to open an account. Unfortunately, we see this kind of deception, fine print and obfuscation everywhere in the world of financial shenanigans.

The banking industry is hyper competitive, where most products and account features are now table stakes, so people are often left comparing institutions based on interest rates, especially now that rates have normalized after the financial crisis. And let’s be real – people don’t dig much further than what’s on the surface (or in the largest font). Therefore, you’d imagine a lot of people are seeing this 6.17% rate and concluding it’s a great deal. And, let’s be honest, most people aren’t very good at math. Do you think BECU doesn’t know this?

The $30.85 Math Deficiency Dividend

The truth of the fine print is that the BECU interest rate policy is effectively wagering $30.85 (the $500 maximum multiplied by the 6.17% teaser rate) in “additional” interest payment to acquire prospective customers who probably don’t know that their rate is deceptive, or that it reverts back to effectively nothing (0.10% APY) after $500 in deposits.

If you plop down $10,000 into a BECU savings account – a pretty small emergency fund – the net rate you receive is 0.40% APY, or $40.35 in total annual interest. That’s (6.17% x $500) + (0.10% on the next $9,500) divided by $10,000. Plenty of other institutions are offering BS-free rates four to five times higher than 0.40% APY. If you’re evaluating BECU as a destination for an emergency fund, I encourage you to look elsewhere. Unfortunately, BECU probably wants consumers to conclude “BECU has good rates” with this kind of marketing.

Can you guess which kind of customers are really good for banks? People who aren’t likely to be financially literate. They pay more fees than otherwise more educated people.

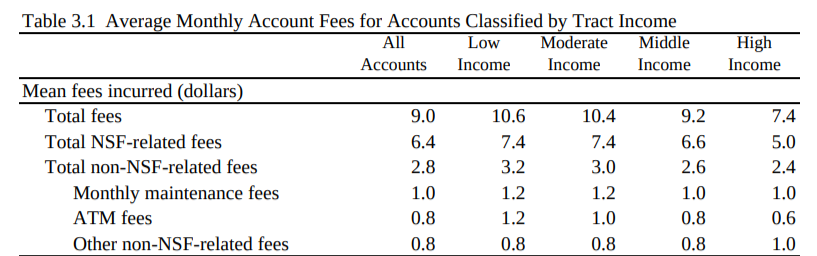

A 2014 study of large banks produced by members of the FDIC, CFPB and the University of Michigan showed, among many interesting data points, two very relevant tidbits:

- High income account holders were much more likely to have college degrees (47.4%) than low income account holders (17.7%)

- Most importantly: Low income account holders paid 43% more in monthly fees ($10.60) as compared to high income account owners ($7.40).

I think you can see what I’m getting at: It’s more profitable to have low income account holders, who are more likely to be less educated.

And just how might one go about getting those less educated account holders? Why, how about some misleading marketing!

Now, if I’m BECU, I might respond by saying that *insert stern tone* “On a risk-adjusted basis, accounting for lending income and charge-offs, your assertion that we are preying on low income customers is just preposterous!”

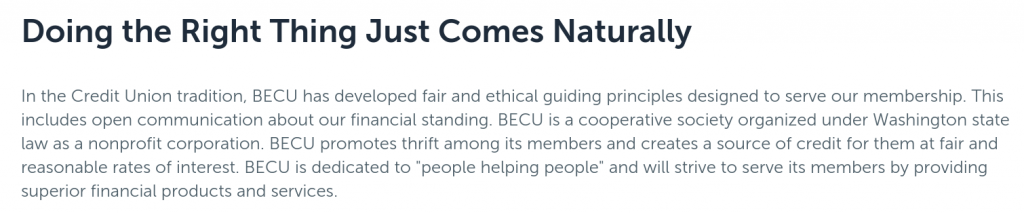

OK, cool. But it still doesn’t explain why this kind of marketing needs to be employed, especially when BECU is all up on their high horse about not being another one of the big banks where slimy marketing/schemes are routinely employed.

Why not just a new account bonus?

Plenty of banks simply offer a sign-up bonus. We’ve all seen these offers somewhere. And BECU is not reinventing the wheel by incentivizing people to open new accounts.

It’s the way BECU is going about offering this $30.85 bonus. Personally, I think it’s sinister and has to be downright embarrassing for those in the organization who want to truly do right by their membership. If viewed as a sign-up bonus, it’s weak compared to competitors. If they offered savings rates at, say, a more honest 0.40% APY, it’s also weak compared to competitors.

Some parting questions:

- Where is leadership? BECU’s well-compensated board members seem like they have pretty busy day jobs, but I still don’t know how they’re giving this a pass.

- Has BECU officially become too big to remember what a credit union is supposed to stand for?

- If BECU members were polled, what percentage of the membership would state they are customers in part to the high interest rates they *think* they’re receiving on checking and savings?

- Why 6.17%? I think I know, but I’d love to hear an answer. Something tells me it’s completely random and irrelevant because it’s there to draw attention. Maybe they had the meeting on June 17th.

Does BECU deserve your money?

With all of this said, this doesn’t necessarily mean BECU should be thrown out as a prospective banking institution. Even I, executioner of bad financial products, am not giving them the full no-go. I know I’m harping on a pretty niche subject. It does, however, fully cement the thought that they are absolutely no different than the big banks now. No longer should anyone consider BECU as some kind of crusader for good in the shady world of personal banking. And don’t buy the sales pitch they they’re a beacon of moral authority or one of the “good guys.”