Financial planning and portfolio management is ripe for disruption, and the “robo” advisors are definitely making inroads. I follow the developments pretty closely and have formed some pretty strong opinions about them. For the most part, they get it – it’s just that there are a few sticking points I believe they’ll need to address to be successful. Obviously it doesn’t benefit me to spell it out for them step by step, but I also know they’re probably not reading this.

One of my gripes is the Schwab cash issue. It’s probably above gripe status – I think they’re acting like full on Wolves of Wall Street on that one. Anyway, on to the point.

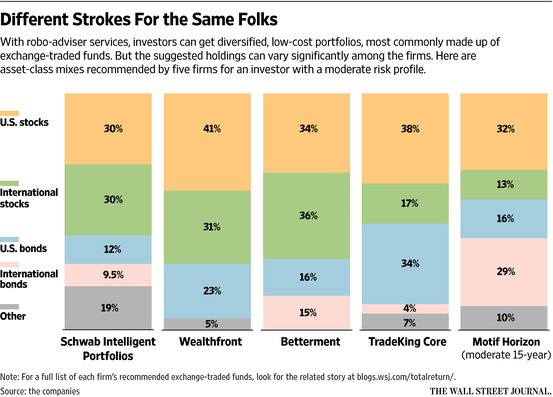

The Wall Street Journal has a great piece online, which breaks down the asset allocation suggestions from each robo for a user with a “moderate risk profile.”

Schwab has what I can only describe as a total “Schwabbed” suite of NINETEEN ETFs as an asset allocation recommendation. This is a ridiculous amount of holdings but it’s not even the point of this note. The details do matter and I think the “robos” will have to do a better job at tailoring portfolios according to a user’s full financial picture instead of assuming every user just sends them their entire investable asset base.

Schwab has what I can only describe as a total “Schwabbed” suite of NINETEEN ETFs as an asset allocation recommendation. This is a ridiculous amount of holdings but it’s not even the point of this note. The details do matter and I think the “robos” will have to do a better job at tailoring portfolios according to a user’s full financial picture instead of assuming every user just sends them their entire investable asset base.

For instance, a majority of the “robo” recommendations in the WSJ piece have an allocation for real estate ETFs. One “robo,” Wealthfront, has no real estate holding slated, but instead recommends a slice of commodities, which is a whole other blog post. Betterment shines again in the WSJ survey, omitting both real estate and commodities – I think they’re the mostly likely “robo” to survive, for what that’s worth.

Back to real estate holdings. I find real estate ETFs, which are usually REIT index funds, are typically an unnecessary asset class for most portfolios. If the home ownership rate in the United States is nearly 66%, then why is it prudent to add real estate exposure to client portfolios? I would be curious to hear the “robos'” answer.

It’s pretty safe to assume that the one third of Americans who don’t own a home are also much less likely to have a portfolio of financial assets ready to invest with a “robo.” And just the opposite, the two-thirds of Americans who own a home are very likely to have assets for investment. It’s also very likely that an investor with a home valued at $200K has their net worth WAY “overexposed” to real estate swings if they have a financial portfolio of $200K as well.

So it stands to reason if you have an investment portfolio then you probably don’t need extra exposure to real estate. Why? If we see another crash in housing of, say 20%, then it’s pretty likely your house will also drop somewhere in the neighborhood of 20%. The same goes for rises in price. I don’t think the slightly different risk exposure of a REIT is sufficient to justify the allocation – REITs are going to live and die by the general value of real estate and housing in their markets. The swings in value of an investor’s home will provide sufficient exposure to real estate.

Plenty of Americans have a big fat mortgage with slim-to-no retirement savings – do they really need more exposure to real estate via REIT ETFs when they finally start investing?

The “robos” will have to incorporate these questions into their client onboarding processes if they want to truly claim their investments are suitable for their clients. I’ve checked a few of them out and haven’t seen these questions being asked. I could be wrong, so, please, “robos,” have your human counterparts contact me if you do indeed take home ownership into account for tailored portfolios.