What does “Independent Investment Advisor” even mean?

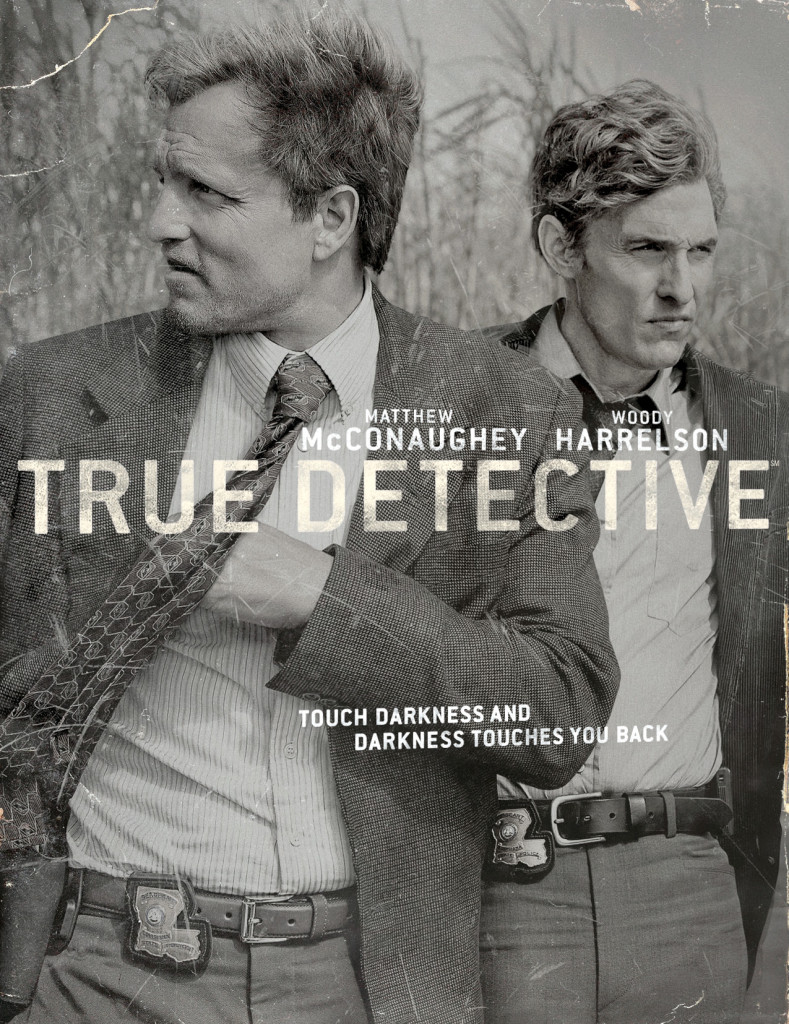

It’s a scary (financial) world out there. Just as the first season of True Detective had its gumshoes searching the seedy underbelly of Louisiana for a serial killer, finding a financial professional with your best interests truly at heart is a dangerous undertaking.

The process seems simple in principle:

You need advice.

Financial Person has the advice.

You have money.

Financial Person gets a little bit of the money for advice.

Case closed, the world is better off! A case study for the gains made by trade, both parties are now better off.

Unfortunately, as we know, the advice seeker is rarely better off. This is why the financial industry has the reputation it does.

Where does it all go wrong? Why do so many people get ripped off, sold bogus financial products while perpetuating a terrible feedback loop for the average investor where inaction, or poor decisions by going it alone, are the norm? The answer lies in incentives, but I believe that more specifically the level of independence a Financial Person possesses is crucial.

Nearly every Financial Person – the brokers, the insurance agents, the CPAs selling mutual funds, among others – are incentivized to sell. They claim to have the advice investors seek but are not required to put client interests above their own and they are beholden to the organizations they work for. Sell or find another job. They are agents of a bigger machine designed to squeeze the sponge that is the lowly advice seeker and his/her peers.

Ask yourself: who does this Financial Person serve? Do they have the leeway to recommend a product, or advise a transfer out, or any other decision that doesn’t have a direct pathway to monetization to them and their employer?

True independence as an investment advisor means I recommend any solution I deem suitable for clients. I don’t have a list of approved funds or products, I don’t receive commission and I have no boss. I don’t have the conflict of being pushed to boost this month’s bonus numbers for the firm I work for. My incentive is ultimately to be trustworthy, which is something that’s earned over time and cannot be packaged in a shiny prospectus, a finely tailored suit or implied with a name on a business card.

True independence allows me to be more like an Amazon.com, working to bring the lowest cost to clients, instead of running a shop where extracting the most revenue possible is my mandate. Simply put: I am betting that doing this the right way will resonate with clients. I am betting that, when educated about how the advice industry actually works, people will choose good advice over shiny objects.

Remaining independent – free from being a financial sponge-squeezer – is how I’ve decided to make my way as a Financial Person. It’s certainly not the path of least resistance to fame and fortune but working for the benefit of clients first is the only way I can be a Financial Person and sleep soundly at night.