“Simplicity is the ultimate sophistication,” da Vinci told us. I agree.

I was inspired to write this post as a sort of open letter to younger professionals, but it’s applicable to any investor with important financial choices coming up soon.

—

By chance, I ended up playing golf with a well-known, younger guy from Seattle as the course was backed up by slow play yesterday (shocker!). He’s in a profession where he’s just starting to make a very large salary and his financial future is bright.

You might ask: “you’re an investment advisor, you gave him a business card, right???”

I didn’t. Not even one of my cheesy custom tees.

I treated it like he was just another golfer. I figured he was golfing to relax and I thought: if I was famous, I’d be so relieved to play 18 holes anonymously!

But what if we got on the topic, and as a young person coming up on the prime earning years of his life, he asked me for my advice on his financial future? Here’s what I’d tell him:

You’re in the top 1% in the world at what you do, but the core of your financial life is very much like any “ordinary” person’s. Sure, you’ll have some added complexity here and there, but every person has the same basic financial needs, whether they earn $40,000 per year or $4,000,000. Holding yourself to a budget, saving for the future, and planning for the unexpected are all key concepts for anyone with a family, an income and a future to plan for.

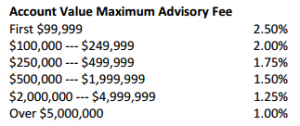

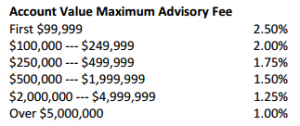

You’re about to run the gauntlet. Your biggest earning years are arriving and there will be a wave of opportunists trying chip large chunks of your money away from you and your family, if they aren’t already silently in place. Be slow to trust, slow to make commitments and quick to discard people and ideas that don’t feel right. Here’s an example of the fee schedule of the company that pops up first with a quick Google search:

Hint: this is way too expensive!

Ask questions. Ask so many questions. Ask questions until you question your ability to ask more questions. Only a trustworthy member of your financial team is going to listen all the way through, and most importantly they’ll be wise enough to tell you when they don’t know an answer. Sometimes “I don’t know” is the most refreshing response.

You don’t need the bells and whistles. There is no secret class of high-performance investments only available to the wealthy, even though this is the popular myth. For instance, hedge funds have a sexy reputation but they have fallen short of expectations. As investors we are so lucky to have a full menu of investment choices available with low cost and high transparency — it’s just not very profitable for the entrenched broker community to recommend them.

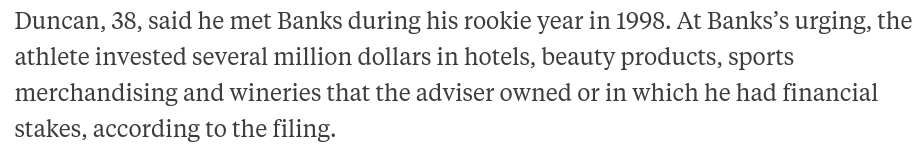

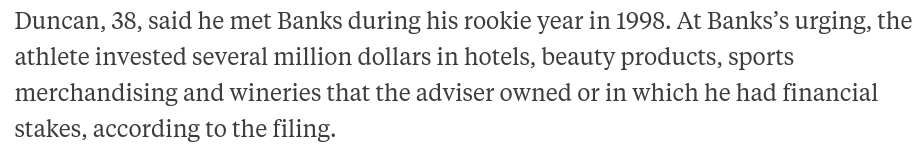

Tim Duncan’s advisor placed his money in complex, illiquid investments

Complexity is your #1 enemy. If you don’t understand it, or it can’t be explained to you in 5 seconds, then you don’t need it. Just take a look at some of Tim Duncan’s horror story:

Complexity = Bad

Diversification is your new BFF. A quarterback has a playbook full of routes to choose from, a pitcher mixes up his stuff every at-bat and a point guard has four teammates with different offensive strengths. Just the same, within your investments you need to be spread across stocks, bonds, and stable pension-like income in case the worst happens. We don’t know exactly how markets will perform on any given time period, just like we don’t know how defenses will set up, what scouting report batters will have or which team member will be double-teamed. Being well-rounded helps deal with uncertainty in sports and investing.

There is no magic bullet, no investing gurus with all the answers and no secret formula to managing a portfolio. Quite simply, the closest thing to a secret formula is this: keep costs low, diversify, and always keep your focus on the long-term. The effect of using these tips to boost your lifetime returns by even just 1% will result in an insane amount of extra gains. A good decision now is much better than a good decision later because the force of a lifetime of compounded interest is so large.

If you don’t know exactly how much something costs you in the wealth management world, you’re probably being ripped off. It’s a sad truth, but many financial product producers bury their price in fine print and the brokers selling them are great at disguising real costs. However, you’re in luck: the truth is the best products are actually the cheapest!

Always choose a fiduciary. This means that the professional you hire is required by law to serve your best interest above all and to avoid conflicts of interest. What if your doctor wasn’t required to do what’s best for your body? You’d probably get a better doctor.

You’re the CEO. The head of a company doesn’t leave important tasks to just one officer; they spread duties according to specialty. It’s very likely you’ll need help with investment management, tax planning, estate planning, among other needs. No one person can provide all of these services, no matter how many designations or assistants they have. In truth, it’s best to split these tasks among professionals at different companies. Just like your investments should be spread out, so should your financial partners. Your team should be willing to work together to serve you. What if Tim Duncan had diversified his team? What if he had checks and balances in place so someone would have raised a red flag when he was a rookie? He’d still have all the hardware but he’d also have a much bigger net worth today.

This list is by no means a perfect roadmap to investing success. It’s merely a call to be skeptical before trusting, and, above all, that simplicity rules in every aspect of investing. If you don’t understand it, what it costs or who it benefits, then it, or they, are not for you.