No, I’m not talking about the 99% versus the 1%. I’m talking about the most powerful force on earth: compound interest.

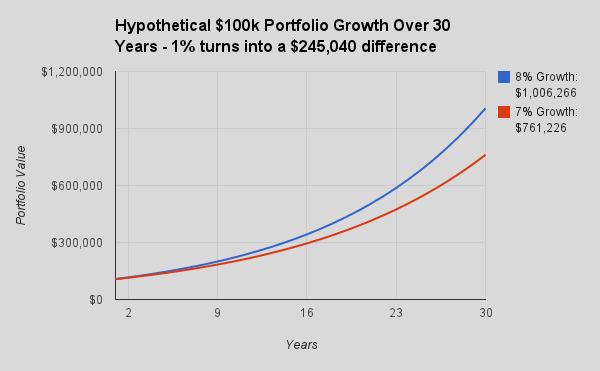

If an investor can earn an extra 1% on their investment portfolio, the effect of compound interest churned over decades reveals a massive windfall. It can be the difference between a comfortable retirement and a nervous retirement.

My goal as an advisor is to make sure every client gets that extra one percent. That said, my strategy to get there has nothing to do with making riskier investments or “beating the market.” It has everything to do with fees: my fees and the expense ratios of your investments.

“In investing, you get what you don’t pay for.” – Jack Bogle, Founder, the Vanguard Group

Let’s say you’ve got your money with Your Guy and he charges you 1%, while the mutual funds his company forces him to sell to you charge you an extra 1% in yearly expense ratios. Enter Alder Cove Capital. My fees, at 0.5% for over $100k in assets, are roughly half of what the average advisor charges for portfolio management and I am not bound by any agreement to sell you expensive investments. Quite the opposite – I can build your entire portfolio using low fees as a major factor going into the selection process. It’s very possible to build a suitable, diversified portfolio with a net, total portfolio expense ratio under 0.2%. No more huge up front commissions on mutual funds, no more Contingent Deferred Sales Charges and no more misaligned interests.

There’s your 1%.

It’s kind of a big deal: