The third quarter wasn’t the best, but that’s OK. Someone important told me there will be days like this:

[gview file=”https://aldercovecapital.com/wp-content/uploads/2015/10/Q315ClientLetter.pdf” save=”1″]Worst TV Commercials for the Average Investor, 2015 Edition

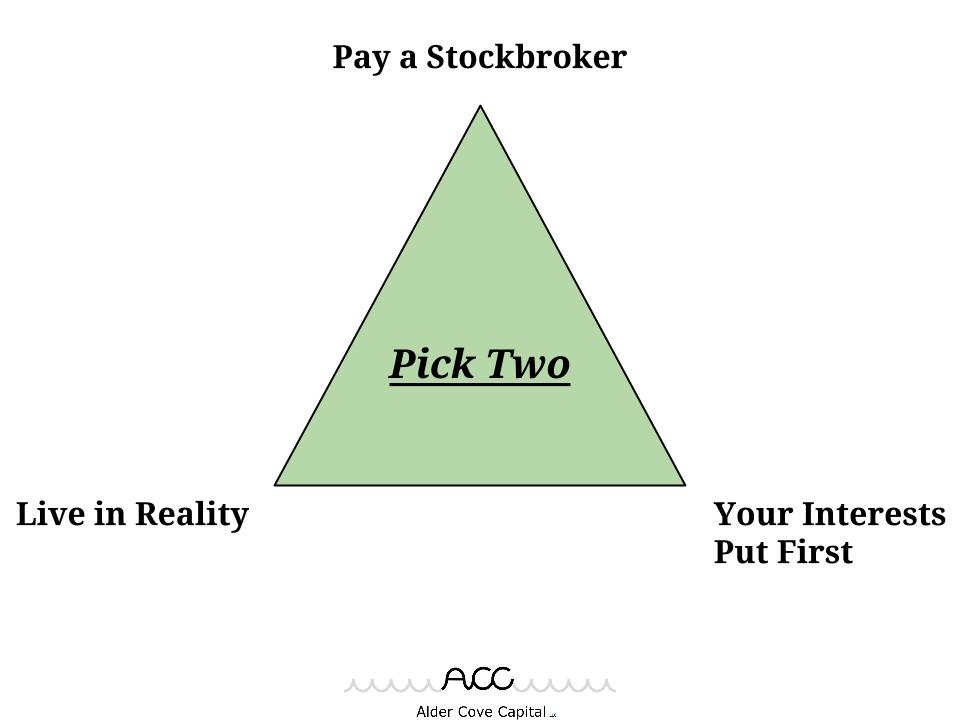

One of the worst things the financial industry does is lead the average “retail” investor to believe they can become the next Warren Buffett if they just get the right trading platform, read the best research reports or pay attention to the right trends.

If you spend any time watching financial television, you’ve come across some of the worst offenders: commercials. Without further ado, here are my picks for the worst three of the year.

#3 – MFS Investment Management – “Active Management”

This one is a buzzword bingo game of epic proportions. “Protect capital long-term.” “Global insights.” “Calculated risks.” “Outperform.” They literally say “active management” SIX times in 30 seconds. We have futuristic touch screens embedded in desks, a massive TV screen on its office wall and a clear emphasis that successful active management depends on traveling the world with a magical black notebook you share with close members of your insider trading network. Active management and its expensive/underperforming characteristics aren’t welcome in these parts, if you’re a new reader.

#2 E*Trade – Opportunity Is Everywhere – “Shoes”

Honestly, this whole post could be dedicated to E*Trade’s horrible commercials but I didn’t want to lay it on TOO heavily. Coming in at #2 is a fine example of how the industry wants average people to think that trading success is as easy as spotting a trend in public and buying a stock. Kevin Spacey seems to sarcastically dismiss this notion at the end of the commercial by saying “but you know the difference” with his trademark gaze after dropping a portable DVD player on the ground. Does E*Trade realize the way he says it contradicts their whole message? Guess not, I’ve seen the commercial quite a bit on financial TV.

#1 E*Trade – Opportunity Is Everywhere – “Fast Food”

This one. Oh, my. Horrible! It’s everything that’s wrong with retail trading and the brokers who enable it. Here we have an Average Joe sitting at the airport with his laptop. He sees a new restaurant with a line. He fires up his browser and reads a few stories about the industry. Enter E*Trade’s Confirmation Bias Enabler, also know as “Browser Trading.” E*Trade has managed to create a device to connect bad decisions to client money in absolute record time – this is quite the accomplishment, must be a lot of high fives at E*Trade HQ for this one. Average Joe can now pull up a website and buy the company’s stock straight from his browser! As we see in the commercial, he is very pleased with himself, as indicated by his slight smirk. Good luck, Joe!

BONUS:

Even more E*Trade, with how to “spot trends before they become trendy,” BEARD EDITION.

Nowhere to Hide

Let’s say you’re a big football fan. Earlier this year, in May, you picked a Sunday this month to see your favorite NFL team play. There’s only 8 home games every year so you decided to pick a September game and shelled out a fortune to see your team play. You figured it would be the best chance for good weather and a good experience.

Well, guess what? – it’s now a soggy Sunday morning on gameday and the forecast shows a 99% chance of the torrential downpour to continue through the evening. What do you do?

Option A – You could try to sell your tickets on the secondary market (at a big loss) while also risking the possibility of both the forecast being wrong and the chance of missing a great game.

OR

Option B – You could just go to the game, pack your warmest waterproof gear and a few hand warmers, and just deal with it. The weather might not be ideal right now, but you’re not going to waste your money and you certainly aren’t going to miss the chance to see your team play a great game.

Option A sees you taking a loss while also taking the chance of missing a great game and/or improving weather.

Option B has major upside compared to option A. There’s definitely a good shot at getting much more value out of the ticket than whatever you could salvage from a scalper. I think you can see where I’m headed with this.

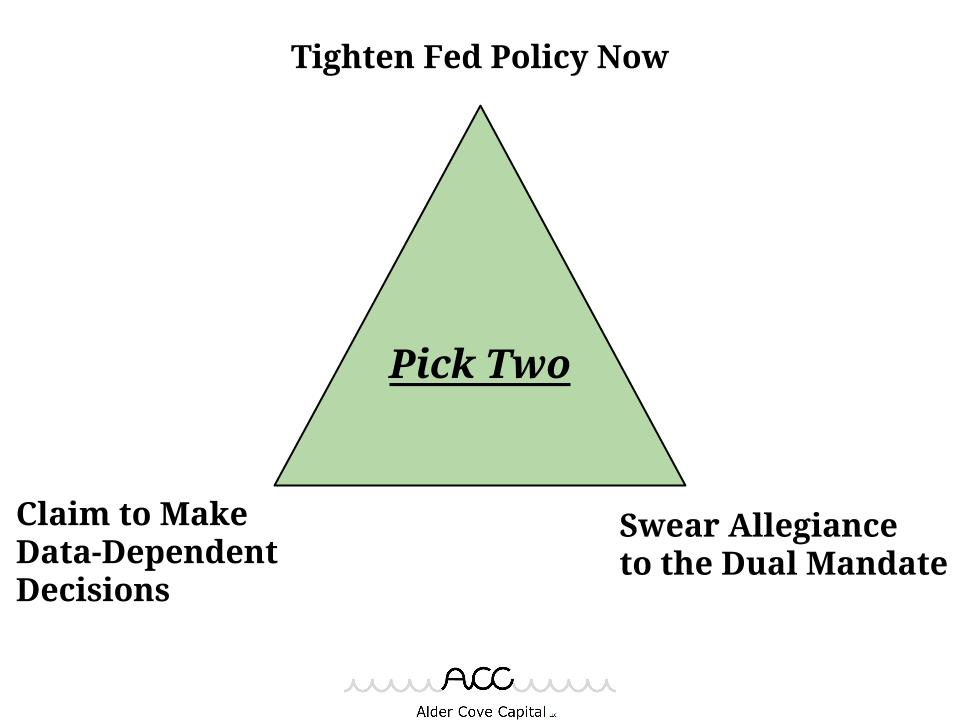

The financial parallel

Right now, a diversified investor is faced with a very similar choice. It’s been pouring down rain in the markets lately and normally there’s that one asset class that keeps the portfolio “afloat” over a given time period, but we don’t have it this time.

The diversified investor hasn’t had fun over the last year and it’s sure tempting to pack up and head home at the next timeout. The last year has produced less-than-stellar returns in the broad spectrum of financial assets and there has truly been nowhere to hide.

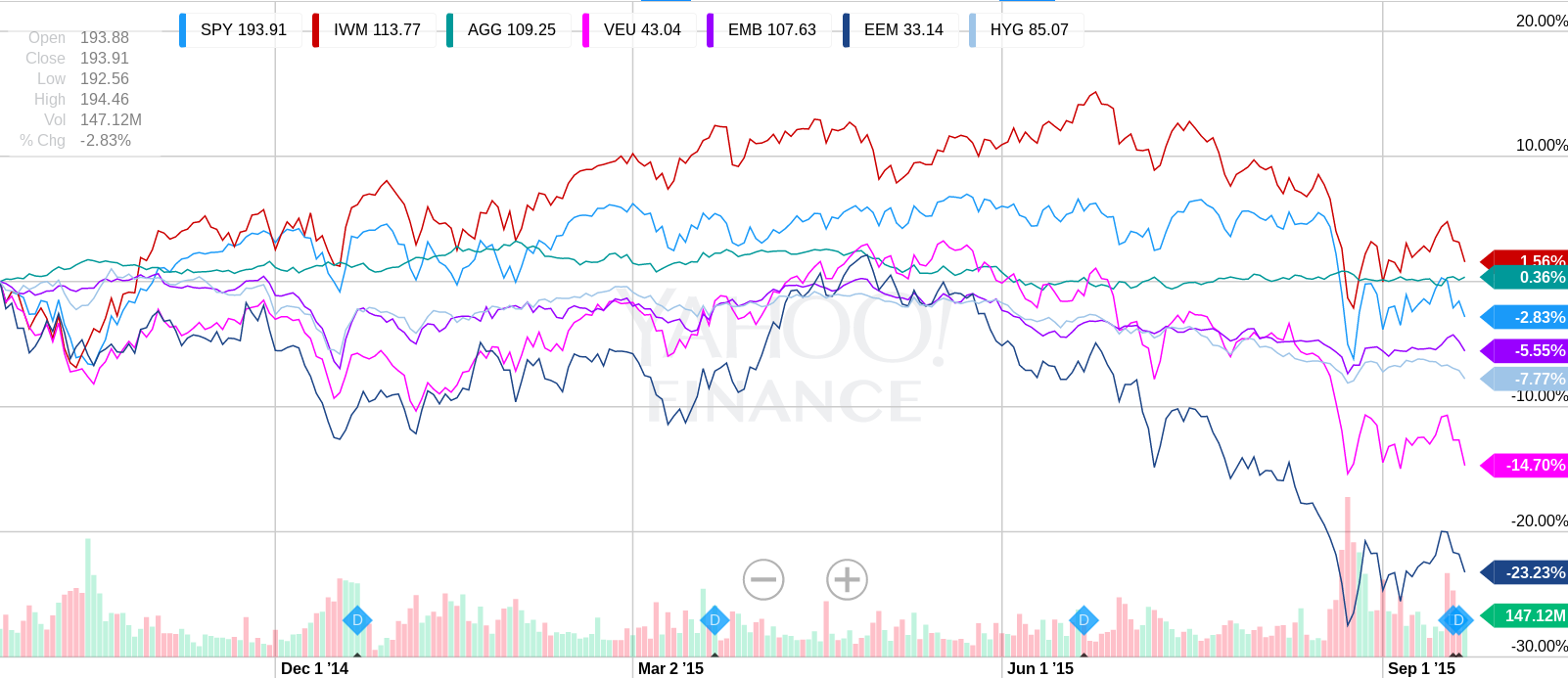

Here are the returns over the last year, as proxied by some popular ETFs, for the S&P 500 (SPY), the Russell 2000 (IWM), the Barclays Aggregate Bond Index (AGG), International Equities (VEU), Emerging Market Bonds (EMB), Emerging Markets equities (EEM), and US High Yield bonds (HYG):

An equal-weighted portfolio of all seven assets would have returned -7.45% over the last year, according to the data provided above. This is a tough number to swallow when we usually see everything compared to big indexes like the S&P 500, which is mostly flat in this time period.

What’s an investor to do?

Option B, all the way.

You’re a long-term investor (fan) and you don’t let a little downside (rain) shake you out of that position (seat). Sometimes, to be blunt, diversification (weather) just simply sucks. You know what’s worse? Selling your portfolio (tickets) at a big loss, missing out on the next leg higher (great game) and enduring the mental damage (mockery from fellow fans) surely to follow.

Athletes often make their most notable performances in the most unlikely situations, just like the biggest rallies in the markets tend to always follow big selloffs. So just choose Option B: go to the game and log out of your account.

If you’re keeping score at home: yes, I am running out of ways to say “ignore your emotions and do nothing.” Halloween is coming up soon, there has to be a pumpkin analogy in there somewhere…