If you absorb nothing else from me, or this blog, just make it this post. Only young at heart? This still applies to you, too.

Important choices about how you allocate your retirement savings could very well be worth millions of dollars in the future, depending on your income level. Future You will really appreciate you making the right call here. I’ll explain below but it’s really nothing more than the most important force in the financial world: compound interest. Learn about it, love it, it’s your new best friend always and forever.

Let’s say you’re 30 years old and you have committed to starting your retirement savings today. Let’s also say you’re a good saver and, on average, will be able to save $7,500 per year for the next 30 years, retiring at age 60. This is saving 15% of a $50,000 income today, a healthy amount but not unreasonable by any means. This sum can be any combination of 401(k) contributions, employer matching contributions, Roth IRA contributions, whatever. You’ll likely get a raise every year so this $7,500 doesn’t even account for that inflation; it will be a lot easier to save this amount in, say, 2025 dollars.

Now that you’ve committed to piling the cash in your accounts, a very wise first choice, your big decision is now at your feet. Are you going to commit to taking a low-cost approach to allocating your accounts or are you going to be tricked into chasing the expensive products the embedded powers of the financial world have been so successful at selling people just like you?

Hint: take the low-cost approach.

Sticking to a diversified portfolio of low-cost index funds is akin to having a secret badge that allows you to pay Wal-Mart prices for Nordstrom-quality goods. Once you understand how the badge works, you’ll never see investing the same again. By opting for passive index funds versus active funds, quite literally you are paying less for a better quality product. Over the long run, index funds outperform active funds yet their expense ratios are much, much lower than active funds.

Quick explanation on “active” versus “passive”: index funds are the best equivalent we have to investing WITH the market as opposed to giving money to some guy in New York who is actively trying to BEAT the market (an active fund). It costs much less to passively run a fund to mimic a preset benchmark like an index (think S&P 500 or Russell 2000), as compared to adding on all of the extra expenses it takes to run an active fund (like research, tons of transaction costs, interns, and fancy offices with expensive coffee machines and couches). This doesn’t even account for the fact that the “active” guys only rarely beat their benchmarks! Further, it’s pretty much impossible to reliably predict who might beat their benchmark consistently.

It’s very likely you have these cheaper, better performing funds offered in your 401(k) but often times they have boring names or the company managing your plan puts them towards the bottom of the list because they don’t make any money from index funds. Trust me: in this case, you want boring. Boring is going to really, seriously pay off in the future.

Sometimes I think investors pay little attention to the costs of investing options because the numbers seem so small. “What’s the big deal with paying 1% extra for this ‘fancy’ seeming fund? I’m used to paying 9% sales tax and tipping 20% at dinner so 1 measly percent extra isn’t a big deal,” you might say. Wrong. The power of this 1% is the key to your big bonus at retirement.

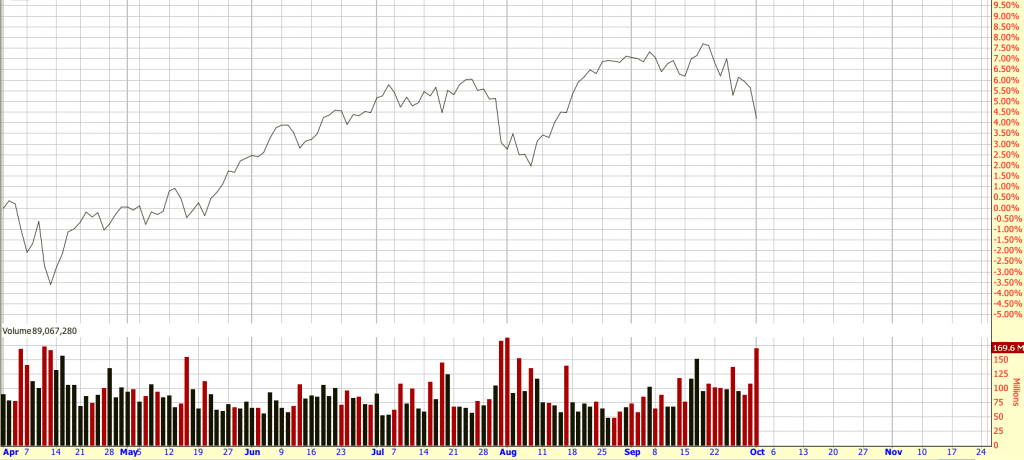

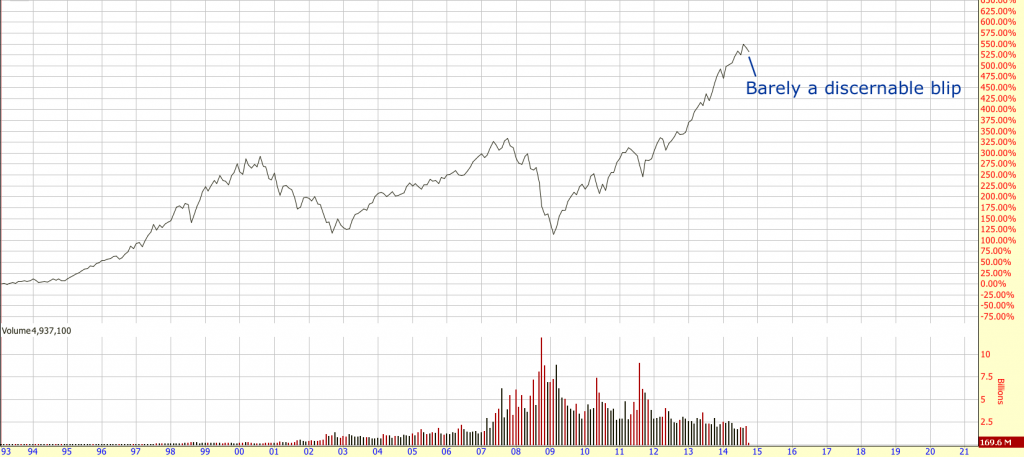

It is very reasonable to assume you will be able to position your investments to enjoy a yearly return at rates one percent higher per year than active funds by keeping expenses lower with index funds (and by default, receiving higher returns due to active funds being perennial underperformers).

I’ll show you the simple calculation.

— Invest $7,500 per year, earn a reasonable 8% return on average per year for 30 years using a low-cost, index fund approach:

Ending value = $849,624

— Invest $7,500 per year, earn 7% on average per year for 30 years because your funds are more expensive and perform worse than index funds:

Ending value = $708,455

Hypothetical difference in 30 years from picking the “boring”, low-cost option =

$141,169

Put another way, this $141,169 is worth an extra 18 years of savings at $7,500 per year. Or you could see it as setting yourself to get paid a nice retirement bonus of nearly three years salary.

With this same scenario, imagine you’re fortunate to enough to earn $150,000 per year and you can still save 15% every year. The potential difference in account balance at retirement from choosing index funds versus active funds? $423,505.

This isn’t a complicated choice, nor is it a complex equation. It’s really as simple as it gets. Be relentless in your saving, minimize expenses to achieve better yearly returns and let the power of compound interest do the rest. A complete no-brainer.