It’s (still) a mess, and Washington state taxpayers should be pissed.

I’m not going to give you a great breakdown on how to choose between Washington’s two plans, GET and DreamAhead. No, this post is a short dispatch on why you should consider other options.

Let’s take a quick, 30,000-foot view of the situation:

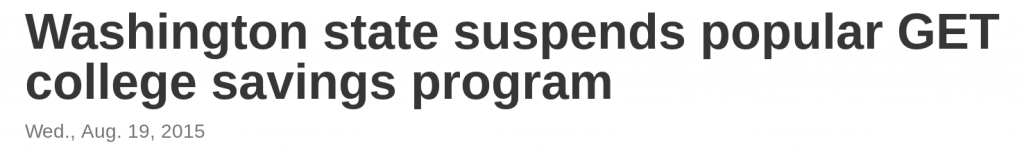

Washington really screwed up its first shot at its GET (Guaranteed Education Tuition) program, a system designed to let residents prepay for college credit as an alternate means of saving for college. To put it nicely, this made for a chaotic experience for those looking to plan for college in the state. Here’s an example of how bad things were:

So, yeah, that wasn’t good.

Then the state tried to fix it by freezing GET for new investors for two years, revamping it, all while introducing in parallel a separate, more traditional 529 college savings plan in 2018, DreamAhead, which is a mainly-DIY tax-advantaged option that most states also offer. They opened a limited window of time for GET participants roll over credits into DreamAhead (and these investors now make up a majority of the accounts in the DreamAhead plan).

Now, informed Washington residents are forced to answer the following question when approaching college savings:

“Do I trust that GET is fixed, and if I don’t, should I opt to go with DreamAhead to save for college?”

Short answers: No, and no. But let me explain why.

The process I use for almost any investing decision goes something like this:

Instead of building a list of good things (“pros”) and spending a lot of time weighing whether or not they overcome the negative things (“cons”), I go right to the cons. Think of a K-9 unit, but a person with a laptop and a cup of coffee, tuned to find financial BS. Most important to this process is the belief that there is no pro good enough to outweigh a “dealbreaker,” which is just a really bad con. Simply put, there are too many reasonable investment options to ever settle for one with really bad attributes – so kick out the bad ones first.

It ends up being much easier to invest by being very picky, declaring early and often when certain attributes are dealbreakers and thus un-investable. (With investing, almost always, cost will be the dealbreaker)

Here’s where GET/DreamAhead come back in.

When approaching the question of how a Washingtonian might save for college today via GET or possibly DreamAhead, I’m looking for dealbreakers, as you might expect. My first hurdle for this process was determining whether the state learned its lesson or not, and if they’ve moved beyond the likelihood of screwing this up again.

It took me about three minutes to figure out that they have not turned the corner. Whatever poison was in the well, whomever is still on such-and-such committee, and however they make decisions – it’s clear they haven’t purged enough. The fly is still in the ointment. The DreamAhead apple did not fall far from the GET Tree. You get it. All you have to do is look at the portfolios offered within DreamAhead:

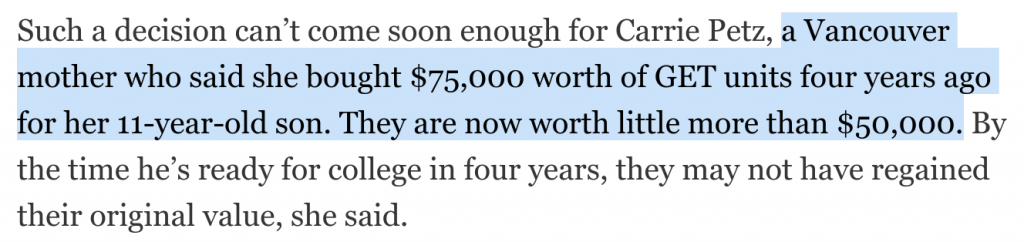

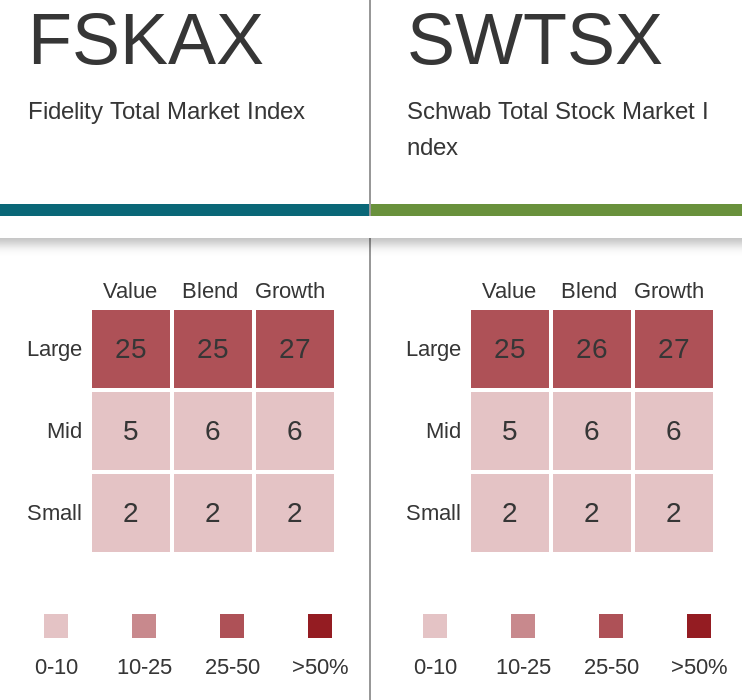

This snapshot is a small slice of a portfolio provided within DreamAhead, and is intended for students expected to start college in 2036. The numbers 24 and 23 indicate the percentage of the account that will be invested in each fund, as follows:

24% in Fidelity’s Total Market Index Fund (ticker: FSKAX).

23% in Schwab’s Total Stock Market Index Fund (ticker: SWTSX).

You don’t need to be a financial expert to see these funds are named similarly. And if you are a financial expert, you’d instantly conclude that these funds are effectively carbon copies of each other. They are virtually indistinguishable from each other. This is not normal to see in a reasonable portfolio managed by “professionals” being paid millions of dollars, let alone in a state plan that should be trying very hard to earn back the trust of investors.

Here’s a look at how both of these funds allocate to size and “style” traits, courtesy of Vanguard:

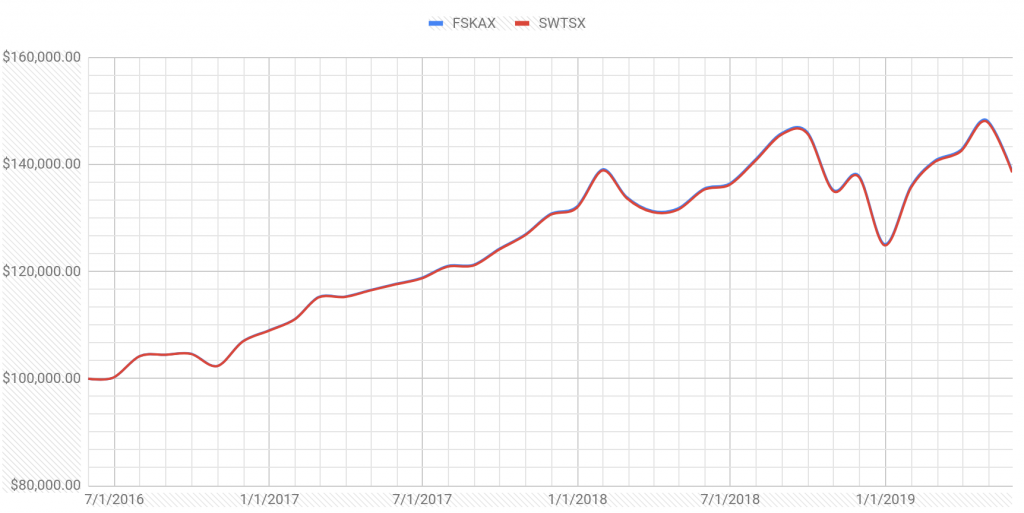

“OK, so their holdings look the same in this weird-looking chart, but what about performance?” you might ask. “Maybe this is where they differ.” Well, here you go:

Red + Blue = Purple.

They’re the same. The line is purple.

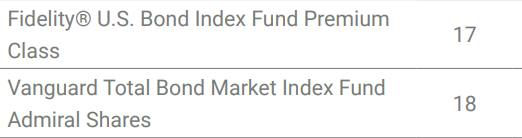

DreamAhead does it with bond funds, too. For all intents and purposes, these two funds in their conservative portfolio are also identical:

A Metaphor Worse Than “Coke or Pepsi”

These weird portfolio choices are not like a restaurant offering both Coke (the Schwab fund) and Pepsi (the Fidelity fund) on the menu, where both Coke and Pepsi fans will be happy. This is also not like a restaurant offering one “cola” by just mixing both Pepsi and Coke, with the result of each party getting at least some of their favorite drink. No, it’s dumber than that.

The perfect metaphor for this portfolio choice is that of a person straddling the Washington/Oregon border with one foot in each state, repeatedly leaning left and then right to take in alternate breaths of air so as they will be diversifying the air they breathe. It’s the same damn air!

To be clear, what we’re looking at here should be considered a nitpick. But when it comes to your money, or your child’s money, or grandma and grandpa’s money, and, more specifically, the future of whomever is being invested for, can there really be a margin for error? On the heels of a major debacle that the state put investors through, can these programs afford to allow financial shenanigans back into its offerings? Can investors look past this weirdness in the portfolio and give DreamAhead the benefit of the doubt that they have reformed? I say, emphatically, no. The proper adult supervision has not made its way to the board room of this program.

Dealbreaker.

Sadly, It Gets Even Worse – Follow the Fees

Remember what I said above about cost? It’s another dealbreaker in DreamAhead, too.

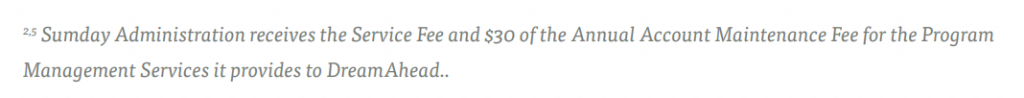

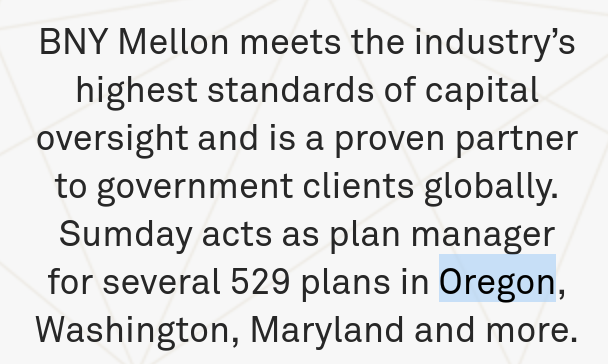

There’s a bit of a messy hierarchy in place — Washington hired Sumday, a subsidiary of BNY Mellon, as its DreamAhead plan manager, but BNY scored another huge victory. BNY also managed to get another subsidiary, Lockwood Advisors, Inc., as the investment advisor on the plan. This means that BNY acts as both the plan manager and the investment advisor on the plan. So it’s fair to assume these entities are all one and the same.

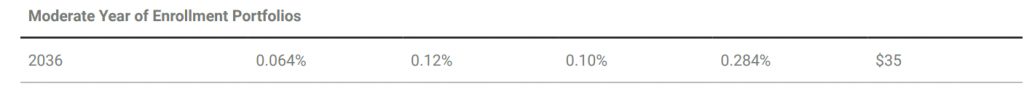

The numbers part of this comes in when we consider how plan participants are charged for using DreamAhead. There are numerous components, but the most relevant being the $35 annual per account fee, of which $30 goes to BNY/Sumday/Lockwood.

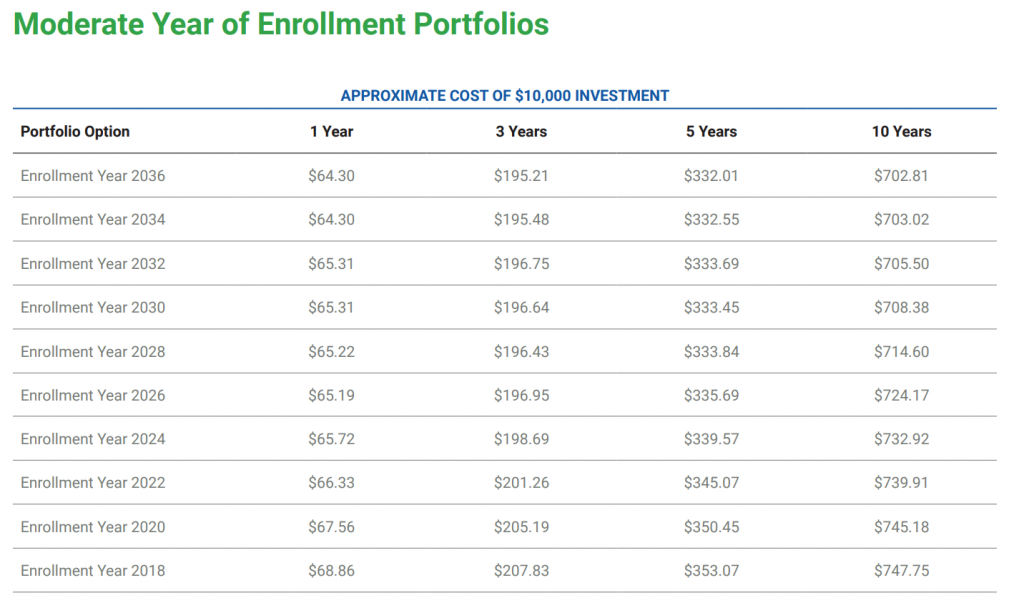

Here is DreamAhead’s cost estimate for a $10,000 lump sum invested over various time periods in moderate year of enrollment portfolios:

Using our familiar 2036 portfolio, we see a total cost of $702.81 over ten years, which means roughly 7% of the original investment is eaten up by fees.

It’s also easy to see that roughly half of the $702.81 is eaten up by the account maintenance fee (10 years x $35 per year = $350).

Oregon Also Uses Sumday, but Investors Pay Less

Our friends to the South also use Sumday as their 529 plan manager:

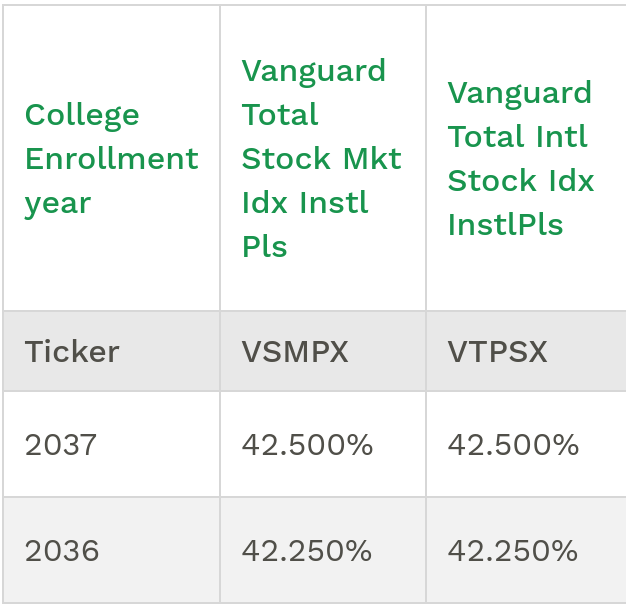

Despite using the same plan manager, Oregon’s investment options for the equity portion of its own 2036 year of enrollment portfolio are not ridiculously constructed with redundant options like Washington’s. They use a simple split between low-cost US and international Vanguard funds:

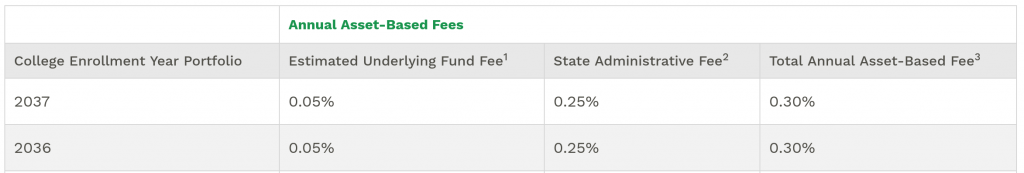

Oregon’s plan does not have the $35 annual maintenance fee:

Here’s how it looks in Washington:

You’ll notice nearly identical asset-based fees (0.30% vs 0.284%), but the real kicker is the added $35 fee in Washington state.

Here’s the same estimate of fees on a $10K investment for Oregon’s plan:

This is a very roundabout way of showing you that Washington state DreamAhead investors are paying nearly double the fees of Oregon 529 investors. Since both states use the same plan manager, Sumday, it’s hard not to conclude that Washington state investors are paying more simply to get a worse portfolio, as overseen by Lockwood, since they are the only major difference between the two plans.

The focus immediately falls on figuring out what BNY/Sumday/Lockwood is doing to earn the extra fee. Either way, I think it’s clear they have done one of the two following things:

— Offered DreamAhead a bonehead portfolio of investments, failing their fiduciary duty to plan participants.

or

— Failed to dissuade the state from implementing its own bonehead portfolio, which I’d say is still failing its fiduciary duty to plan participants (along with the failure of those in charge at the state).

Now, don’t get me wrong. BNY/Sumday/Lockwood knows the portfolio is boneheaded – they employ plenty of smart people. It’s plain to see if you know what you’re looking at. It should evoke various forms of “Why the hell would anyone build a portfolio like this?” from anyone who cares to look closely.

Now, at worst, the fact that this DreamAhead portfolio made it to the menu is akin to the existence of a hidden watermark on a photo or a line of code an engineer hides because they think no one will notice it. It would be an Easter Egg / middle finger and a reminder that there is still an epidemic of allowing a false portrayal of sophistication to those who don’t know any better.

Let me spell it out, if the worst case scenario is true:

More funds in the portfolio, even if they’re duplicates —> Imply complexity and sophistication —> Fee justification for BNY/Sumday/Lockwood.

(This would be the most damning accusation on my part, and I’m plenty willing to be convinced that BNY/Sumday/Lockwood tried their best to fix the portfolio)

But at very best, this is another absolute failure by the state of Washington to put adult supervision in the room. To hire the right people. To listen to the right voices.

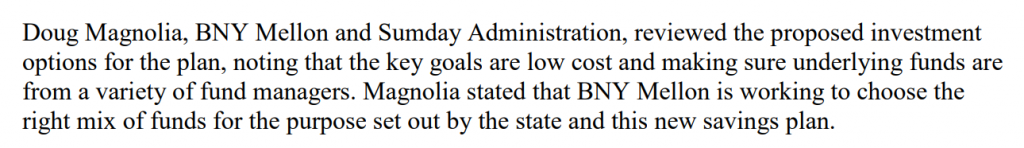

But it doesn’t look very good for BNY/Sumday/Lockwood. Even Sumday’s CEO, Doug Magnolia, gave the then-proposed investing options his stamp of approval in November 2017, shunning the opportunity to declare concerns about the options on the table, according to meeting minutes that are publicly available:

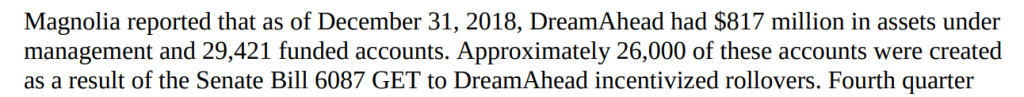

In the latest update, Magnolia updates the state on how DreamAhead is doing:

I’ll do the math: $817 million multiplied by the portion of the asset-based fee that goes to BNY/Sumday/Lockwood (0.12%) is equal to $980,400. Then, we multiply the 29,421 accounts by the $30 portion of the $35 annual account maintenance fee that BNY/Sumday/Lockwood receives, which totals another $882,630. In total, BNY/Sumday/Lockwood is collecting at an annual rate of over $1.8 million in fees from investors, growing as new accounts and assets rise. Pretty nice haul.

A Bad Plan Gets Bad Results

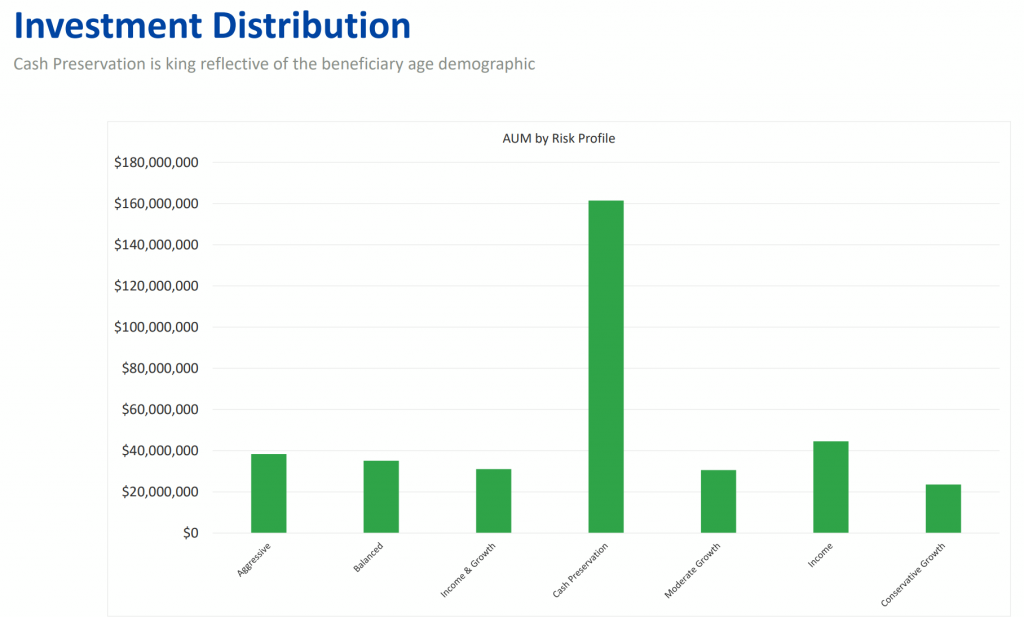

Here’s another indicator of something you don’t want to see in a 529 plan:

The whole purpose of a tax-advantaged investing account is pretty simple: Take advantage of the tax benefits given, so you can compound investing gains over a longer time horizon. You put money in, it grows tax-free, you take it out and spend on college tax-free. Even those looking to enroll soon, or are already enrolled, don’t necessarily need to be in 100% money market funds. Here’s why seeing this lopsided split is a problem:

- Sitting in money market funds is not investing.

- Having low, or no gains before funds are withdrawn for college expenses wipes away any/most tax benefit available, thus defeating the purpose of using a 529 plan. It simply becomes a transfer of wealth to the plan manager via fees.

- BNY/Sumday/Lockwood is incentivized to not fix this issue because an uninformed investor is a profitable investor. Low volatility – as is the case with “investing” in “cash preservation” – leads to the reduced probability of losing accounts due to investors being risk intolerant. This stable allocation of safety also leads to a very steady and predictable income flow for BNY/Sumday/Lockwood.

- With so many choices on the investing menu, along with confusing terms like “Income & Growth,” many investors are likely retreating to the implied safety of cash preservation. Here are how many choices a DreamAhead investor has to navigate before settling on an option:

- Conservative Year of Enrollment Portfolio

- Moderate Year of Enrollment Portfolio

- Growth Year of Enrollment Portfolio

- Cash Preservation Portfolio

- Income Portfolio

- Income & Growth Portfolio

- Balanced Portfolio

- Conservative Growth Portfolio

- Moderate Growth Portfolio

- Growth Portfolio

“Cash Preservation. Yeah, I like that sound of that. I’d certainly like to preserve my cash.” — Investors, who have too many options and not enough help from the advisors they’re paying.

Conclusion: Fool Me Once…

The conclusion is simple: Washingtonians, save for college elsewhere. Don’t do it in Washington, unless there is a radical change in leadership with GET/DreamAhead. The program can’t be trusted and has shown it hasn’t learned from its past mistakes. Residents can use any other state’s 529 plan without restriction because there are no in-state tax incentives for college savings to remain in-state as Washingtonians. One might start with Nevada’s plan, led by Vanguard. Or start with Morningstar’s list of best plans.