Frequently Asked Questions

Let's take a look at some common questions, as answered by advisor/founder Tyler Linsten:

Further questions? Please don't hesitate to ask me at tyler@aldercovecapital.com.

Or check out What I Believe.

Or quickly schedule a chat here.

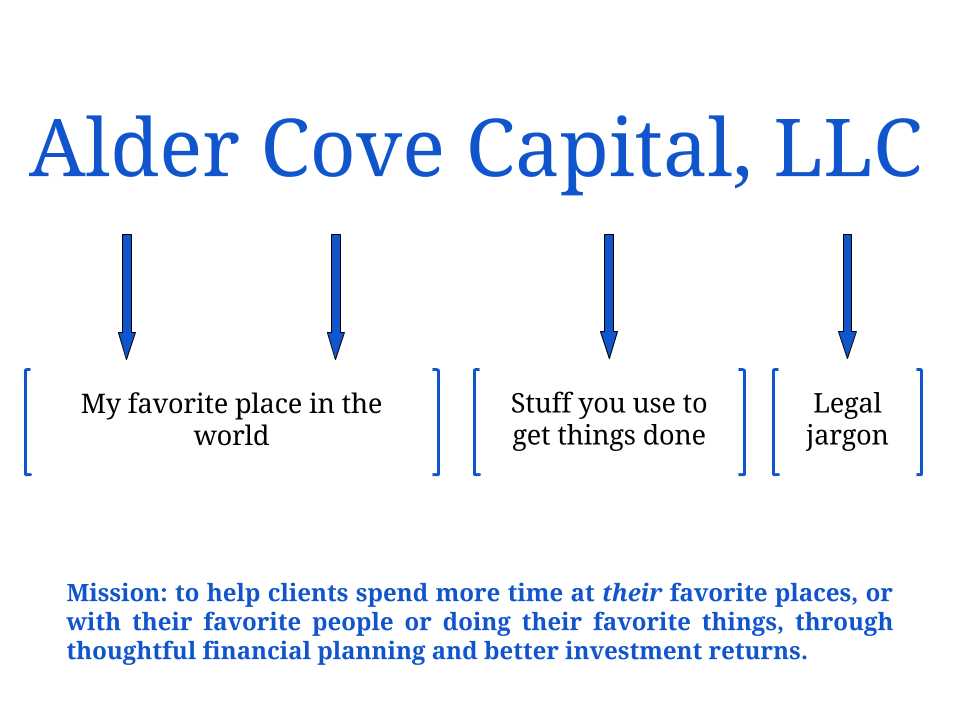

These terms refer to how this advisory firm is set up.

Independent: This means Alder Cove Capital, LLC is not a subsidiary of any larger entity. I own the firm and I work for clients - they're the boss. No one else calls the shots.

Fee-only: This means the only way the advisory firm earns revenue is through client portfolio management or financial planning fees. There are no commissions, no trailing 12b-1 fees, no product referral kickbacks, no BS.

Fiduciary: Set up as a Registered Investment Adviser firm in Washington State, this advisory has a legal requirement (a fiduciary duty) to put client best interest first.

Quite honestly, the only way I can earn your trust is through developing a relationship where I establish that clear communication and ethical behavior come first. Nothing I say to you on a website should earn your trust, nor should any affiliated company bring a sense of security with any advisor; I can only earn trust through proving a commitment to practicing the principles I preach. I hope it becomes glaringly obvious that I am focused on representing and promoting what capital markets should be: transparent and fair. Beginning a dialogue is the only way we can start to build trust.

I have passed all three levels of the CFA Program. The CFA Institute designs its exams with a rigorous focus on ethical and professional standards. Have a question? Just ask! I'm happy to talk all things finance with anyone. There's no shakedown or sales pitch here.

A detailed pricing page with calculator can be found here.

All new clients pay a flat financial planning fee upfront when we begin work together. The one-time fee depends on the complexity of the topics we'll be working on. This fee covers us for up to six months of financial planning work together. Clients who want ongoing help can later opt into using Portfolio Management Services.

For ongoing portfolio management, clients pay a fee (broken up quarterly), based on the assets managed, at 0.50% per year.

I prefer to try to charge as little as possible to manage portfolios, instead of as much as possible, because I know how excessive fees will eat away at investment returns. My commitment to minimizing the fees you pay on your investments does not come with an asterisk.

The only compensation I receive comes from client fees. I am not paid by any mutual fund companies to sell you their expensive products, nor do I receive any referral fees and I have even taken careful steps to avoid obtaining licenses that allow me to sell products based on commission. Further, I receive no compensation based on performance, where excessive risk could be an incentive. The only way I create income is by establishing a long-term advisor/client relationship where we work together to meet your long-term financial goals. Too much effort, and wealth, is wasted on short-term thinking.

More detail on fees and services can be found here.

Never, at any point, do I take custody of client assets. Betterment Advisor Solutions and Schwab Advisor Services are the third-party custodians I work with to maintain your accounts if you opt for ongoing portfolio management services. If we work together on a one-time planning project then there's no need to transfer any assets to a custodian as I would simply give you my recommendations. Betterment for Advisors and Schwab Advisor Services work with independent registered investment advisors, like Alder Cove Capital, LLC, and they provide my clients and my business with timely, tailored service.

Clients only send deposits or transfers directly to their custodian. I am simply authorized to allocate and manage their investments. Betterment for Advisors and Schwab Advisor Services act as third party custodians and they also provide clients with the ability to view their accounts online at any time on the web, or with their mobile apps.

Every client is a little bit different, but generally we start by taking a look at the bigger picture of your financial life. We'll compare your long-term goals to how your current savings, income and expenses may or may not have you on track. I seek to get everything organized in on central spot in your client website so we can then allocate your investments properly and work on financial planning objectives. It is paramount you are properly allocated according to your ability and willingness to tolerate risk. Many financial mistakes are purely psychological biases so it's important I get to know what makes clients tick and only then can we begin to effectively measure and reach goals.

I do not run a mutual fund (where racking up expenses while trying to beat the market, and usually losing, is the norm) - in fact, most of the time we opt to invest WITH the market instead of trying to beat it. If after our initial meeting you want to move forward then we simply sign an agreement detailing our arrangement. I avoid complex financial instruments and a typical client will have a globally diversified mix of stocks, bonds and shorter-term cash and fixed income. The official Form ADV Part 2A "brochure" for Alder Cove Capital, LLC can be found here. This document will provide much of the same information as a client investment advisory contract.

I like to work with people ready to get their hands a little bit dirty when it comes to reaching their goals and getting their questions answered. There will be forms to fill out, documents to gather, questionnaires to complete and there might be some new technology to learn. But there is major "sweat equity" created when clients take ownership of their financial lives.

I get a huge kick out of reversing the trend of high-cost, low-value financial advice one client at a time.