They’re more similar than you think.

Whenever I watch a movie or get into a TV show, I inevitably end up thinking about how I’d rate it. I also inevitably end up annoying my soon-to-be-wife by forcing her to rate it, too (sorry!). But in pure nerd fashion, I’ve spent a lot of time thinking about the best system to rate movies and shows. A 3-star system? 4-star? 5-star? Scale of 10? I’ve settled on a 4-star scale – here’s why, how it relates to investing and how it likely trickles down to your portfolio if you’re a client.

It should be noted that half stars are tempting but should always be fiercely denied by all reviewers. Moving on…

The reason why I’ve settled on a 4-star system is I think it maximizes the sum of the simplicity of the system plus the forced thoughtfulness from the reviewer.

A 2-star system, like the “Thumbs Up or Down” Siskel and Ebert used, is overly-simplified and too binary for me. “Yes” or “No” just doesn’t cut it. I’d end up with about 90% in the “No” category. Siskel and Ebert never held true to their 2-star system, anyway. They’d say things like “mild thumbs up” or “two thumbs way down.”

A 3-star system is overly simplified and allows for “cop-out” 2-star rankings. It’s too easy to just land at a 2 and call it good. Only having three choices means movies or shows are either bad (1), great (3), or in the middle (2).

A 5-star system forces a little more thought and gives more options – “very good but not great” at 4 stars, for example – but it still offers the cop-out 3-star, middle-of-the-road rating.

A system with the scale of 10 goes overboard on choices and you inevitably end up with ratings that have no meaning. Is there really a meaningful difference between a 7 and an 8? If you watched the movie again a year later, there’s a chance you could rate it anywhere from a 6 to a 9 depending on whether the popcorn was good that day or not. The scale of 10 system does, at least, avoid a cop-out middle ground. 1-5 and 6-10 are distinctly either on the “good” or “bad” side of 50/50.

Don’t even get me started with a 1-100 scale.

The 4-star system is perfect. It’s neat, forces thought and has no cop-out rating. 1-star is terrible and wasn’t worthy of finishing. 2-star is watchable but not twice. 3-star is good but not top shelf. 4-star is great and is reserved for only a few shows or movies per year, at very most. Personally, I guard the 4-star rating like it’s gold. I’m probably too stingy about my 4s but we won’t go down that path. An even more simple breakdown:

1-star = Hated It

2-star = Tolerated It

3-star = Liked It

4-star = Loved It

What’s the point?

Building an appropriate investment portfolio is remarkably similar to the movie ratings system: Prefer simplicity, avoid middle ground cop-outs and be thoughtful.

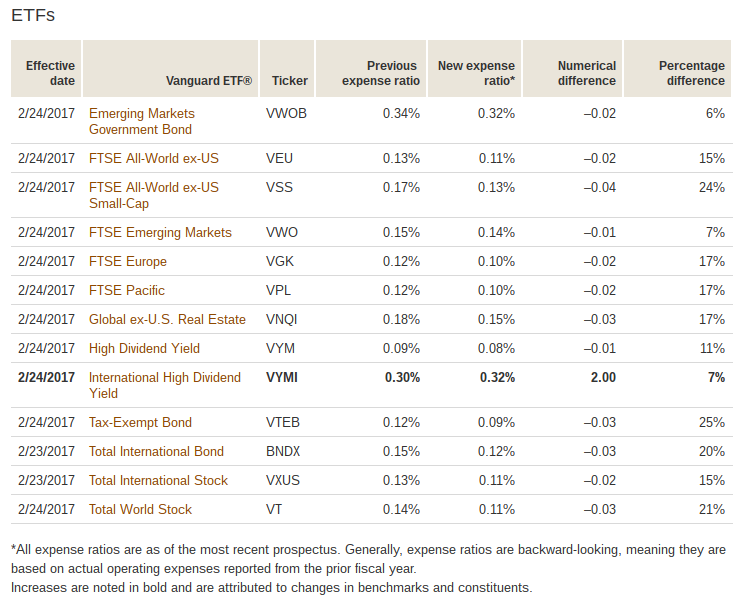

The biggest factor in determining how risky a portfolio is will always simply be its exposure to equities. Yes, you could fill a portfolio to the brim with extremely risky bonds, but I’m assuming you’re not crazy and you use low-cost index funds and are globally diversified in any scenario.

Let’s now apply the 4-star rating system to portfolio management (which I do practice), and we will see how four distinct results work really well:

1-star = Preservation

2-star = Conservative

3-star = Standard

4-star = Aggressive

20% Stocks / 80% Bonds: Preservation

Better suited for an emergency account, a retiree with more immediate liquidity needs, or for someone with a large aversion to risk. Will not feel much pain even in the worst equity bear markets.

40% Stocks / 60% Bonds: Conservative

Leans conservative but has higher equity exposure and is best suited for someone with either a below average risk tolerance or a shorter time horizon.

60% Stocks / Bonds 40%: Standard

This mix has been a fixture for a reason. 60/40 leans aggressive (there’s that forced decision when you don’t have a middle ground to settle on). 60/40 makes sense for someone with an average risk tolerance and a medium-term time horizon. Will take a significant hit in a bear market but even in the 08/09 crash, a 60/40 portfolio took less than two years to recover.

80% Stocks / 20% Bonds: Aggressive

This “4-star” equivalent is for those investors with both longer-term time horizons and above average risk tolerance (and not just one or the other, a very important distinction). This allocation will get shellacked in a bear market, for sure, but that’s why you have me to tell you it’ll all be just fine.

(Note: A 0% stocks / 100% bonds portfolio or 100% stocks / 0% bonds portfolio violates the sacred law of diversification and thus doesn’t make the cut for consideration, no matter a client’s circumstances or risk appetite)

I’ve seen plenty of portfolio allocations that explicitly recommend something silly like exactly 43% stocks. Truth be told, there really isn’t a material difference between 43/57 and 40/60 and it’s exactly why I recommend these simple, round targets for client portfolios. Diving deeper within those round targets, there’s much more to getting a prudent spread between different factors like small/large capitalization, domestic and foreign, as well as value versus cap-weighted, but that’s for another blog post.

So what do you think? Thumbs up or thumbs down? Let me know! tyler@aldercovecapital.com