Everyone’s favorite four letter word – budget! – strikes fear into the hearts of even the most nerdy. Only a small percentage of the population embraces budgeting and usually it involves a weird combination of cash and envelopes. This isn’t a call to join the envelopers.

I’m with the rest of the world: I don’t like budgeting. I don’t recommend people create rigid budgets. I do recommend, however, that people do a reasonable assessment of their annual spending. A no-BS assessment, to be perfectly clear. It’s not a “budget” in the sense that it involves painful decisions or spending cuts. This is an assessment of how much it costs to live your life. Not how you’d like to live, but actually how you live it today. You might be surprised, good or bad, but at least you’ll know.

There should be ample scribbling. It should take time. Not five minutes of time. Many logins will likely be reset or used for the first time in months. Papers will be shuffled. It should be done once a year, every year. This will simply be a starting point, a reference, for other financial matters in your life like how much to contribute towards retirement or, yes, how much to cut back in certain areas.

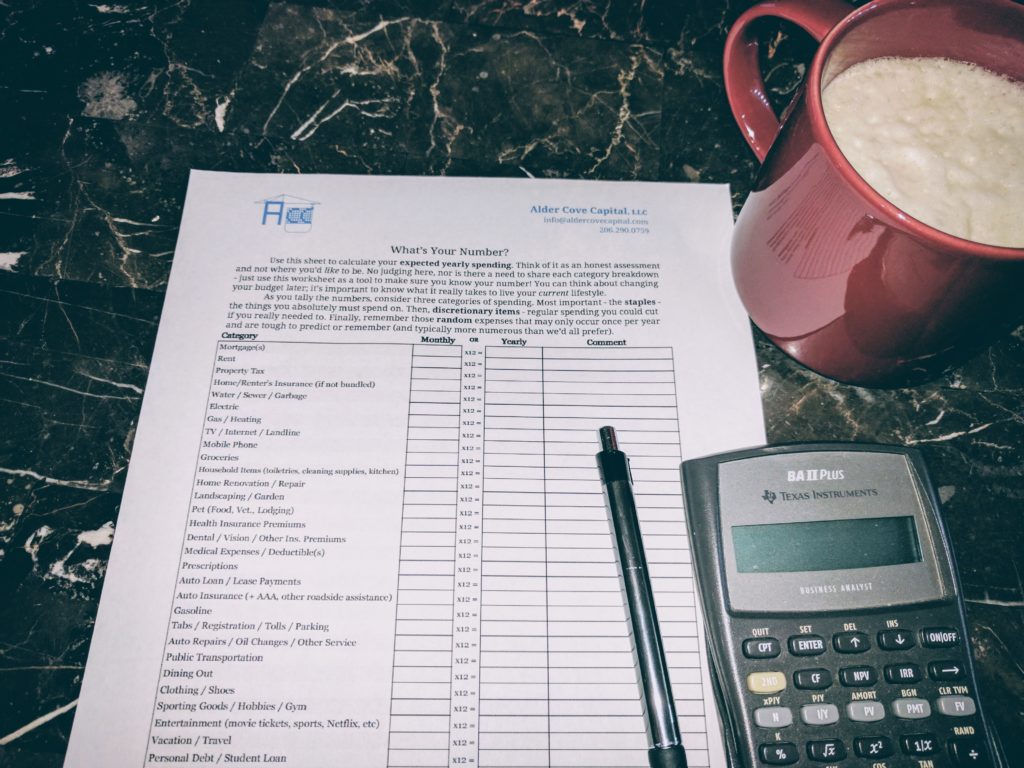

On spending, people either “get it” or they don’t. It’s a binary situation. The best way to get it is to commit to being familiar with your cash flow. Spending less than you earn has probably the highest ratio of obviousness-to-actual-use of all pieces of advice, but the first step is knowing where you’re at. So grab a coffee, a calculator, a writing utensil and get to work!

Download the one-pager “What’s Your Number” worksheet right here!