When winning is losing.

An exciting part of helping people with their portfolios is seeing what kind of BS they’ve been stuck with, and then reversing it immediately. Usually, the most common culprits are high-fee funds with fancy names. This week produced an all-time worst.

Behold, Legg Mason’s QS Global Market Neutral Fund. Ticker: LNFIX.

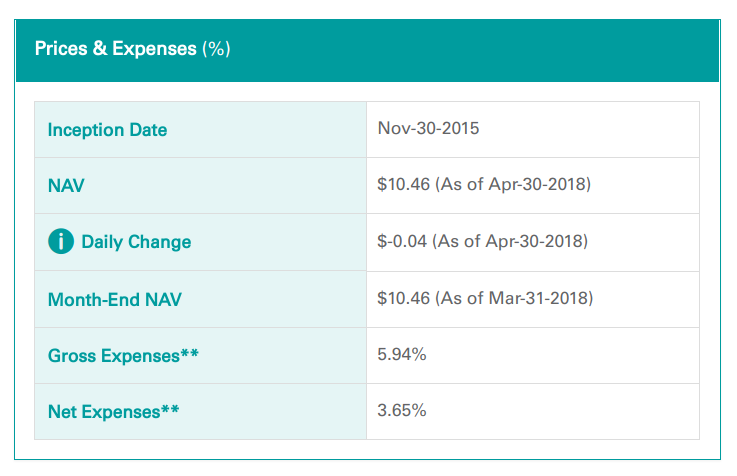

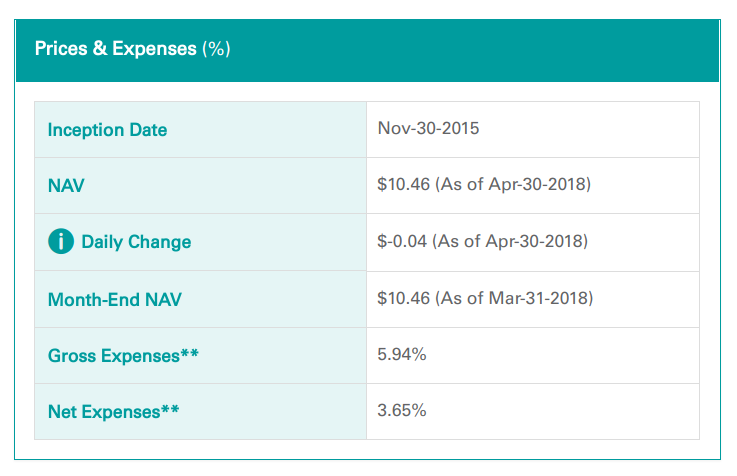

This particular younger client was stuck with this fund comprising 100% of two different IRAs they own, likely because it was very profitable for someone to do so, and the expense ratio is, get ready for it…

No, I don’t think you’re ready yet…

Have you grabbed a paper bag in anticipation of hyperventilating?…

Get one.

Take a deep breath…

Grip the bag and put it up to your mouth.

The expense ratio is…

…

…

…

…

…

…

THREE.

POINT.

SIX.

FIVE.

PERCENT.

3.65%!

Three hundred and sixty-five basis points!

Treat it like a solar eclipse – use eye protection if you must look.

LNFIX is over 91 times more expensive than Vanguard’s Total Stock Market Index ETF, which costs only .04% per year. This is by far the worst fund I’ve ever seen in someone’s portfolio. Usually you only hear about these kinds of wealth evaporators second hand through some guy you knew back in the day, or on archived internet forums from the 90s.

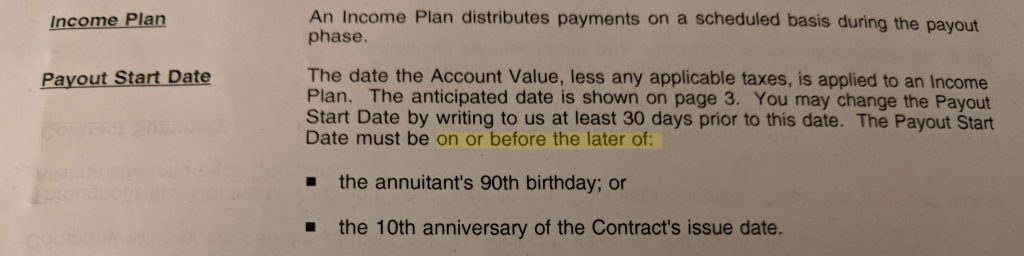

I can only imagine that those who willingly buy products like this have a strategy of investing only in funds whose ticker symbols were written on bathroom stalls in gas stations in the middle of nowhere. A market neutral strategy — making some bets for securities to go up, with other bets for things to go down, resulting in only exposure to the manager’s potential skill, or lack thereof — is a painfully inappropriate strategy for a young person, with decades to invest, to put all of their account into. The worst part of it all was this client had to pay a 5.75% sales charge before even getting their money invested. This also means the fund has to not only earn more than the inflation rate, but the inflation rate PLUS 3.65% every year in order to show a real appreciation. Also laughable: They compare the fund to US T-Bills on the website, as if to boldly imply it can be considered to be in the same ballpark as a risk-free asset like Treasuries.

I joke and endlessly lay on the sarcasm, but this is a damn shame. We need a true fiduciary rule applying to the entire investing industry.