No, it’s not to move to Canada. Yet.

The end of 2017 brought a massive overhaul to federal tax law. There are numerous implications, complications and very few simplifications.

You won’t be able to do your taxes on a post card. Sorry, Ivanka.

I’m not going to provide a detailed write-up of changes, or offer up any unsolicited Hot Tax Tips for 2018 and Beyond. That’s been done elsewhere by specialists, and to view all of the changes you have Google. I can’t one-up the work that’s already out there. (Shoutout to clients: Obviously, I’m going to reach out if there’s something I think will need attention in your personal situation)

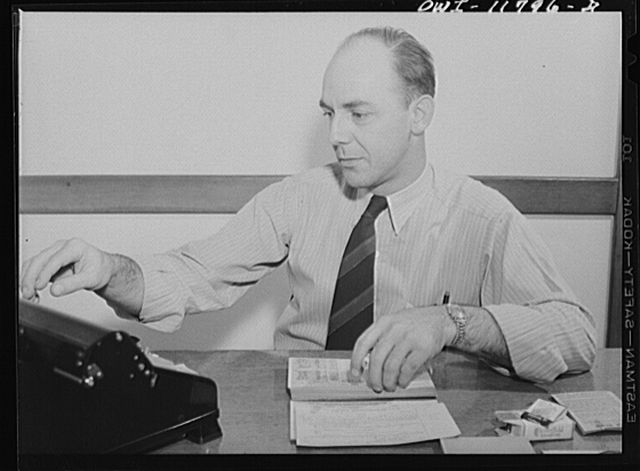

What I am going to do is suggest you make sure you have a “Tax Gal” or a “Tax Guy.” The peace of mind that comes with having someone in your tax corner can’t be understated, especially considering how the landscape has changed in just the last month alone. Hiring a tax professional you trust is absolutely worth the small outlay. In all likelihood, hiring one will pay for itself because the chances are good they will squeeze more out of your tax return than it costs to hire them.

Important caveat: If your tax situation is pretty “plain vanilla” – you won’t be eligible for many deductions, and aren’t dealing with immediate college/retirement planning, taxable capital gains/losses, divorce, or a home purchase/sale and don’t own a business – then you can probably skip this recommendation and file your own taxes online. A pretty fair assumption is that the older, er, more experienced you are, the more likely it is that you should get an accountant.

So, who should you hire, and how to find them? Start with asking around for referrals from friends or family. Then, check their background. Use Yelp. Do a Better Business Bureau search to see if there if there is a disproportionate amount of complaints on file for the subjects of your search. Figure out if they’ll help you in the case of a future audit. Just be sure to do your homework and don’t be afraid to ask questions about process and pricing.

I’d encourage you to look for a CPA and stay away from the big shops like H&R Block. Using the big firms’ software for very simple situations is great, but they’re not known for producing ideal results for walk-in style tax engagements. They’re incentivized to get bodies in and out of the door. The less personalized method of going to one of the big shops takes away from the face-to-face, ongoing relationship you’d be establishing with an accountant you’d visit at least yearly. Hiring someone for the long-term brings accountability.

Most importantly, find someone you trust who values your time and your business. It’s very likely to be worth much more than the nominal price you pay. Kinda like hiring an investment advisor (wink, wink).