Yeah, you. Knock it off.

If you have any kind of sizable amount of cash saved outside of your retirement accounts, and many people do, then you’re probably passing up a nice chunk of change by letting it sit idle, earning little-to-nothing in interest. It’s understandable. You just accumulated it in a checking or savings account at your favorite bank, and it’s annoying to open new accounts. Inflation has been pretty low so you’re not too worried about earning nothing. And pretty much everything is better than opening a bank account.

But now you can be paid handsomely all year for a few minutes of your time today.

This is a serious move in the interest rate on US Treasury Bills, and yields on savings accounts have followed.

Seemingly overnight, we’re back to a more “normal” interest rate environment. The Fed is raising rates and banks are more comfortable hiking their own rates on deposits. This is something you need to take advantage of. Here’s why:

Let’s say you have $50,000 in annual expenses. A very reasonable amount of cash to have in reserve for an emergency account could be deemed six months’ worth of expenses, or $25,000. Plop that amount in an account yielding just 1.85% APY (annual percentage yield) and, voila, you’re now making $462.50 per year for barely lifting a finger. Even if it takes you half an hour to set up the new savings account and link your old checking/savings account, it’s basically the equivalent of earning over $900/hr for your time.

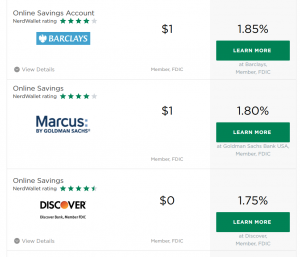

It’s super easy. Do an online search for banks with FDIC insurance and then you can sort according to yield. If you have no allegiance to specific brands or features then you’re free to decide based on yield. Here’s a search I was able to pull up via Nerd Wallet:

That’s it. We’re no longer in an interest rate environment where it doesn’t matter where your cash sits. Take advantage of the sea change and pay yourself. Future You will like this.