Let’s say you’re a big football fan. Earlier this year, in May, you picked a Sunday this month to see your favorite NFL team play. There’s only 8 home games every year so you decided to pick a September game and shelled out a fortune to see your team play. You figured it would be the best chance for good weather and a good experience.

Well, guess what? – it’s now a soggy Sunday morning on gameday and the forecast shows a 99% chance of the torrential downpour to continue through the evening. What do you do?

Option A – You could try to sell your tickets on the secondary market (at a big loss) while also risking the possibility of both the forecast being wrong and the chance of missing a great game.

OR

Option B – You could just go to the game, pack your warmest waterproof gear and a few hand warmers, and just deal with it. The weather might not be ideal right now, but you’re not going to waste your money and you certainly aren’t going to miss the chance to see your team play a great game.

Option A sees you taking a loss while also taking the chance of missing a great game and/or improving weather.

Option B has major upside compared to option A. There’s definitely a good shot at getting much more value out of the ticket than whatever you could salvage from a scalper. I think you can see where I’m headed with this.

The financial parallel

Right now, a diversified investor is faced with a very similar choice. It’s been pouring down rain in the markets lately and normally there’s that one asset class that keeps the portfolio “afloat” over a given time period, but we don’t have it this time.

The diversified investor hasn’t had fun over the last year and it’s sure tempting to pack up and head home at the next timeout. The last year has produced less-than-stellar returns in the broad spectrum of financial assets and there has truly been nowhere to hide.

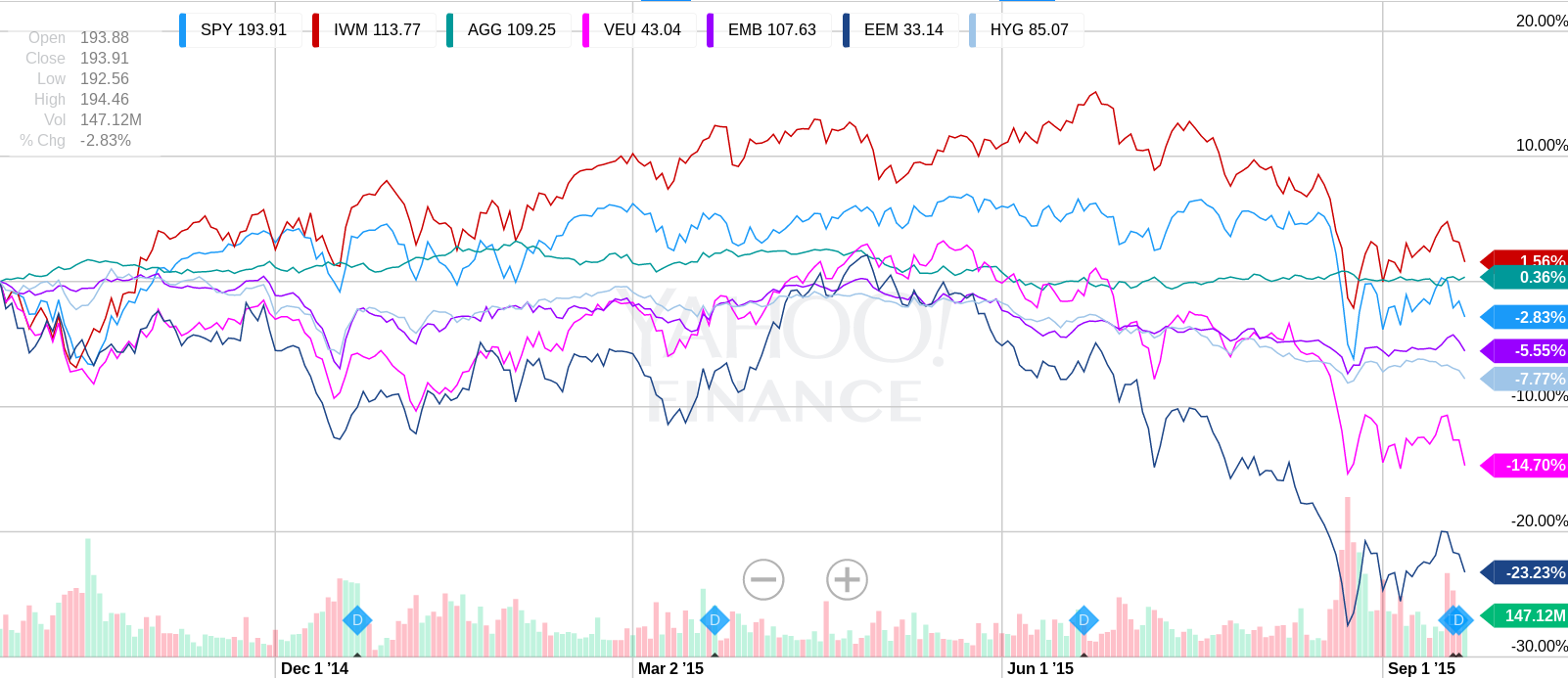

Here are the returns over the last year, as proxied by some popular ETFs, for the S&P 500 (SPY), the Russell 2000 (IWM), the Barclays Aggregate Bond Index (AGG), International Equities (VEU), Emerging Market Bonds (EMB), Emerging Markets equities (EEM), and US High Yield bonds (HYG):

An equal-weighted portfolio of all seven assets would have returned -7.45% over the last year, according to the data provided above. This is a tough number to swallow when we usually see everything compared to big indexes like the S&P 500, which is mostly flat in this time period.

What’s an investor to do?

Option B, all the way.

You’re a long-term investor (fan) and you don’t let a little downside (rain) shake you out of that position (seat). Sometimes, to be blunt, diversification (weather) just simply sucks. You know what’s worse? Selling your portfolio (tickets) at a big loss, missing out on the next leg higher (great game) and enduring the mental damage (mockery from fellow fans) surely to follow.

Athletes often make their most notable performances in the most unlikely situations, just like the biggest rallies in the markets tend to always follow big selloffs. So just choose Option B: go to the game and log out of your account.

If you’re keeping score at home: yes, I am running out of ways to say “ignore your emotions and do nothing.” Halloween is coming up soon, there has to be a pumpkin analogy in there somewhere…