It’s really hard to start a new financial habit and in some cases it’s even harder to change one already in place. We have routines, tendencies and grooves worn in the pathways where our money flows. After all, it’s basic physics: an object in motion will stay in motion unless acted on by an outside force. Your habit is that moving object and sometimes it’s necessary to take action and change its direction, or to stop it completely.

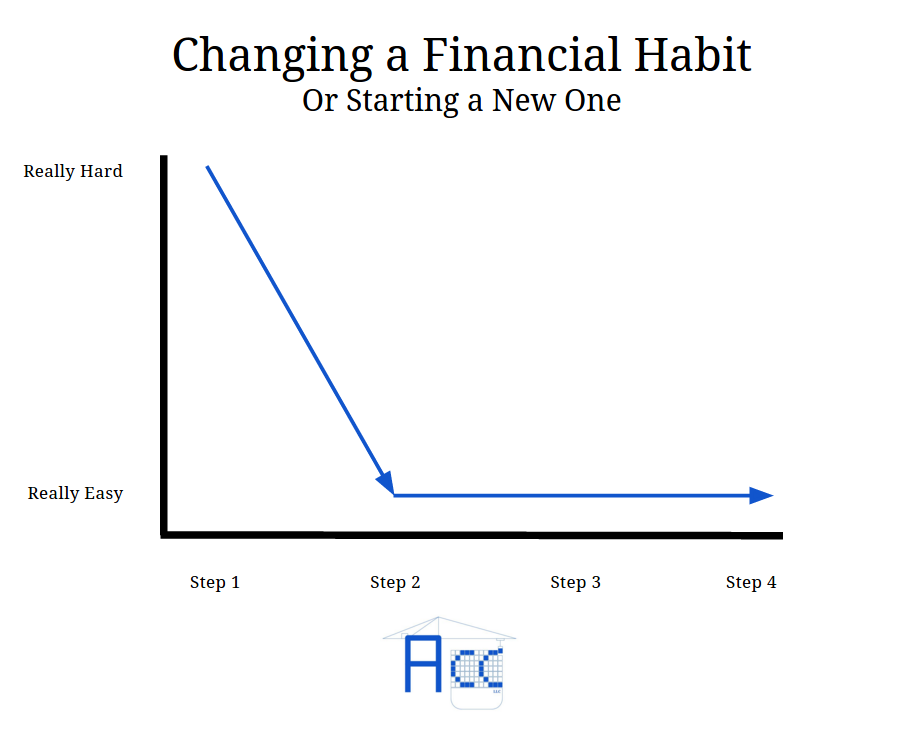

Changing habits is not an easy task but this simple chart shows it gets much better after that first step. Since money triggers such emotion in most people it’s understandable we take great effort to avoid making decisions and changes. The bright side: the first step is just like any other task at its core. The worst step of getting a nagging toothache fixed is making the appointment, right? Once the appointment is made, it’s all downhill from there – usually it’s the time spent thinking about committing to get to the dentist that brings the most anxiety instead of the procedure itself. The same goes for financial habits. From opening a new high-yield savings account, to logging in to bump up a 401(k) contribution, or scheduling auto-pay to reduce a loan balance, the hardest part of a positive financial habit really is the first step.

I’ll bet you nearly every single Step 1 in the hopper takes two minutes or less!