A few weeks ago, the unofficial king of the do-it-yourself, financial-independence/retire-early investing crowd, Pete Adeney, AKA Mr. Money Mustache, updated his post on his Lending Club “experiment.”

I’ve been a vocal critic of Pete’s because I feel the influence he commands with his blog has led him to be a bit slimy. Long story short, Pete sets up affiliate marketing relationships with the products he recommends and in turn he makes a shitload of money from his blog ($400,000 per year) when people sign up for these products or view ads. My beef with him got started after Lending Club was revealed to have acted to defraud its investors (they lied about the loans they sold to institutional investors and also had disclosure issues regarding loans purchased by the CEO’s family) but Pete kept on recommending Lending Club and he kept on raking in the dough from his referrals.

As a certain someone might say in a tweet: “Not very nice!” I think he has a responsibility – regulated advisor or not – to behave better than this.

Here’s a blurb on why Pete is only just now deciding to ditch Lending Club:

You can read the post, but in short Pete saw his account value go down slightly (about 1%!) so he’s sounding the alarm and ditching the account. OK…? Given his reluctance to tell his followers to sell after “alleged” fraudulent activity(!) at Lending Club, it was already safe to say that if you’re getting your financial advice from internet blog posts created by a hobbyist with massive conflicts of interest, you might want to change your mind and diversify your advice sources. This update further proves my point.

But it’s a little worse.

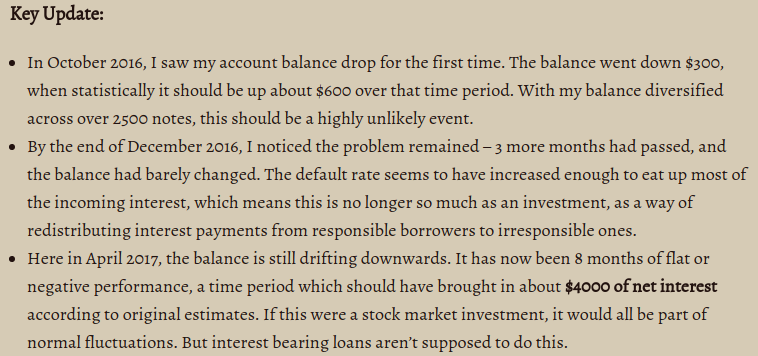

Here’s further proof Pete just doesn’t really get what it’s like to own a portfolio of loans (the “fixed” part is only fixed until somebody decides not to pay), even if there is broad-based diversification:

The balance dropped! Oh no. With regard to fluctuation, “interest bearing loans aren’t supposed to do this” is an unbelievably naive statement. Fixed income products have to be repriced when interest rates (and other factors) change, otherwise arbitrage opportunities are available. The idea that Lending Club provides a simple “set it and forget it” super stable money making machine is just not accurate. (There is a secondary market for these loans and I suspect many investors are in for a shock if they attempt to liquidate early, as we’ll see below)

It’s one thing to say “well, I don’t want to face any losses so I’m cutting and running,” but that isn’t what Pete is doing. He’s implying that something is wrong with the way these loans are working and that’s just not the case. Delinquencies are rising and his balances should naturally take a hit. That’s not hard to understand. Interest rates, in general, are up, which naturally puts pressure on fixed income products, too.

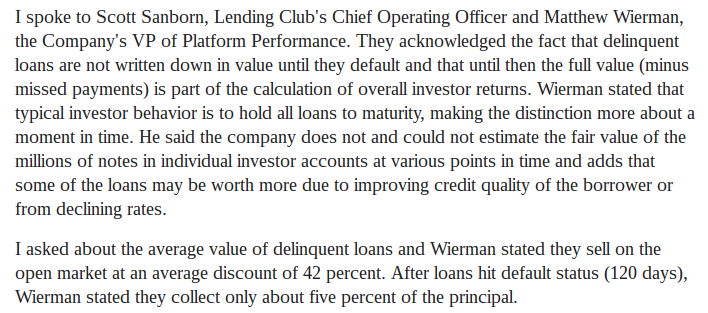

Allan Roth wrote a great article featured at CBS News, and this passage might help:

In summary, rising delinquencies – as Pete has experienced – bring a delayed hit to Lending Club account balances since they’re not “marked to market” until they’re officially dead. Pete’s portfolio is now seeing those defaults, he thinks the system is broken (or something?), and it’s also a bit of another knock on Lending Club for promoting a snazzy, continuously updated rate of return when in reality some of the underlying loans are effectively zombies and negative returns could be just around the corner.

So what’s the deal, Pete?

The “losses” shown are basically a 1% downtick in account value. Not to defend Lending Club, but I’d love to know how this is any different than an emotional investor selling at the first sign of a paper loss. Or is there something more to the updated opinion? Unfortunately, Pete is not just a regular investor dinking around with alternative assets. He’s an influencer with a massive, money-minting megaphone and he’s dangerous to his readers. He should have backed out months ago and now he’s blaming factors he seems to not understand are 100% inherent in fixed income investing.

Conclusion: I think it’s still safe to say that following the advice of online mustaches is a task best done skeptically.

Pete, you’re out of your element.