Click for the personal finance angle, stay for the recipe at the end.

Food waste is a huge problem. This piece in the Seattle Times estimates the number to be $1500 per household in the US. I waste more than I’d like, and I bet you do, too. Just like other financial hacks – like opening a high-yield savings account or diverting spending through a cash-back credit card – minimizing a painful line item like food waste can have a big effect on your annual finances.

As we know, lower spending equals more savings.

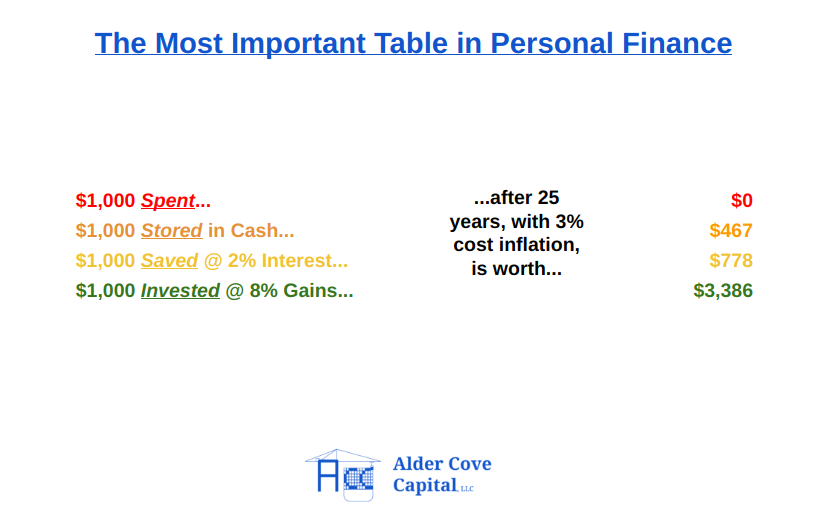

And more savings equals more dollars flowing into the Magic Compounding Machine, also known as your long-term investing portfolio.

And more money in the Magic Compounding Machine means you’re closer to doing whatever it is you want to be doing with your money.

If we think of it in terms just like the other financial hacks I mentioned, it’s pretty compelling:

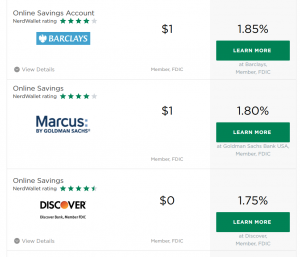

- Use high yield savings account (yielding 1.90% today, versus 0.05%) on $25K in emergency savings account: Gain $462.50 per year

- Use 2% cash-back credit card for $30K in annual spending (and never carrying a balance), versus using a debit card: Gain $600 per year

- Cut food waste in half by being more conscientious and getting creative with cooking: Gain ~$750 per year

So there’s $1812.50 we just found. That’s not nothing. It’s very much something for most people and for someone earning $60,000 per year this is the equivalent of a perpetual 3% raise in pay.

Oh yeah, here’s the recipe from the Times article. Sounds pretty tasty:

Serves 3 or 4

Use any melting-friendly cheeses you’ve got — the more the merrier; cheddar, jack, mozzarella and Gruyère all work great in strata. For your extras, more is more, too; the last one I made had green onion, prosciutto and lots of rosemary, and it came out fantastic (and I don’t even especially love rosemary). And you can sub half-and-half for the milk and cream. If you have leftovers, they reheat perfectly: Just pour a little half-and-half, cream, milk or stock over them to revive, then bake covered for 20 minutes at 375 degrees, or microwave.

About 6 to 8 slices of bread (about 6 cups cubed)

5 eggs

1¼ cups whole milk

1¼ cups whipping cream

1 teaspoon salt

Several dashes of hot sauce

2 (or more!) cups grated cheese

A couple handfuls of extras, e.g., chopped onion (green or otherwise); mushrooms or zucchini; pieces of ham or prosciutto; bits of cooked bacon or sausage; any kind of fresh herb(s), chopped

1. Preheat oven to 350 degrees.

2. Butter a 2-quart or 2-liter casserole dish.

3. Cut or tear bread into about 1-inch cubes (a serrated knife works nicely).

4. In a medium bowl, mix the eggs, cream, milk, salt and hot sauce (a hand blender is quicker than a whisk).

5. Make a layer of about a third of the bread cubes in the bottom of the casserole dish, and sprinkle with about a third of the cheese and half of your extras; repeat for another layer, then top with the remaining bread cubes and cheese.

6. Pour the egg mixture into the casserole. (If you want to make it ahead, it can be refrigerated now all day or overnight before cooking.)

7. Bake at 350 degrees for 40 minutes; let rest about 10 minutes before serving.