I like to make sure you know I’m doing my homework, Dear Reader. As a bit of a contrarian (and weirdo?), I like to take pictures or screenshots of some of the stupid investing-related stuff I come across on either the internet or print. The garbage accumulates in my Google Photos library and it’s fun to see what has piled up over a given year.

Consider this post to be a visual “spam folder” for the year 2016. Here are some of my favorites:

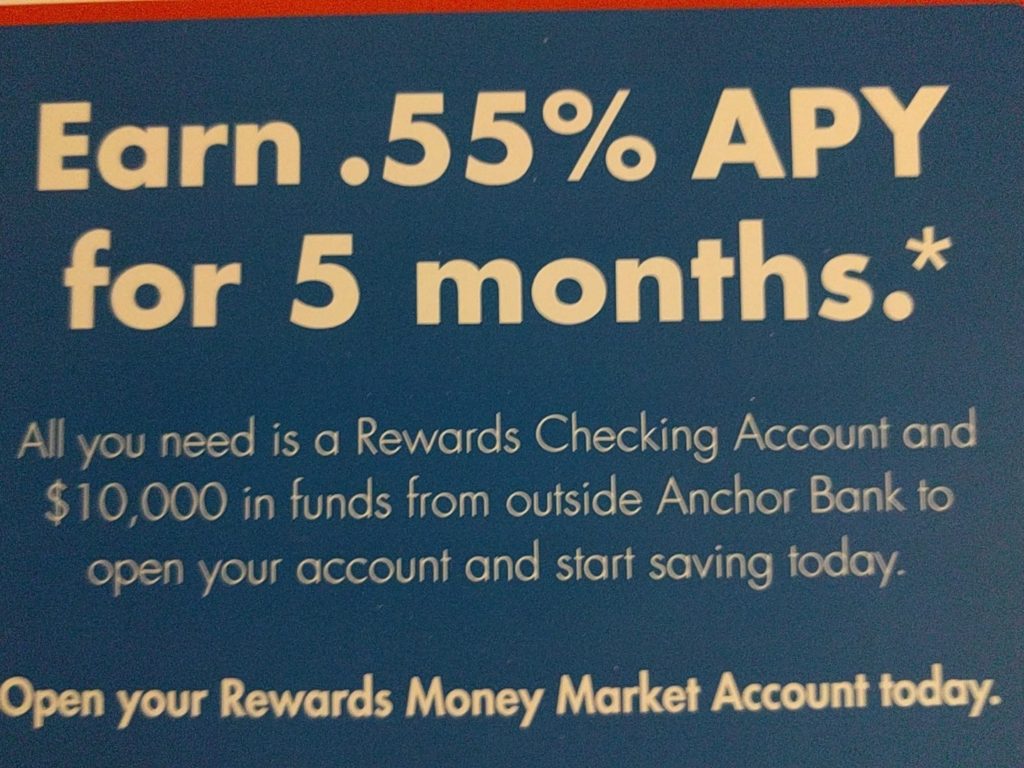

BIG MONEY!*

*You’d need roughly $436,000 invested in your Rewards Money Market Account to earn a thousand dollars interest over their five months teaser term. Don’t move up your retirement date just yet.

Beware the Golden Shoes!

This was one of those “40 Under 40” photo ops where financial advisor recipients may or may not have paid for the right to appear in this picture. The humble parts of the investing profession are working hard to reinforce their reputation as working for clients while remaining grounded – so how, exactly, Golden Shoes Guy(!), does your footwear choice move that cause forward?

Self-explanatory Garbage Post from Business Insider

There’s always some technical indicator predicting the next crash and coincidentally they tend to occur most frequently on slow summer news days. No, we didn’t crash. Yes, equity markets are pretty much at all-time highs right now. Avoid these articles – always.

An Homage to “Step Brothers?”

This picture was taken in Seattle’s booming/bubbly SoDo district.

Fake-sounding business name? Check. Unrelated, vague business units? Check. At least they appear to be diversified! Sort of.

You make the call:

“Prestige Worldwide: the first word in entertainment.

Management, financial portfolios, insurance, computers, black leather gloves, research and development.

Putting in the man hours to study the science of what you need.

Last week we put liquid paper on a bee and it…died.

Security.

Investors? Possibly you!”

All jokes aside, I wish you luck, Logic 20/20.

Bad Advice in the Reach for Yield

The following except of an article was highlighting how to earn more in a low-rate environment. I shudder when I think of how many people are trying to get creative instead of remaining disciplined. You will be in for a rude awakening if you start to choose stocks versus bonds based solely on their yields.

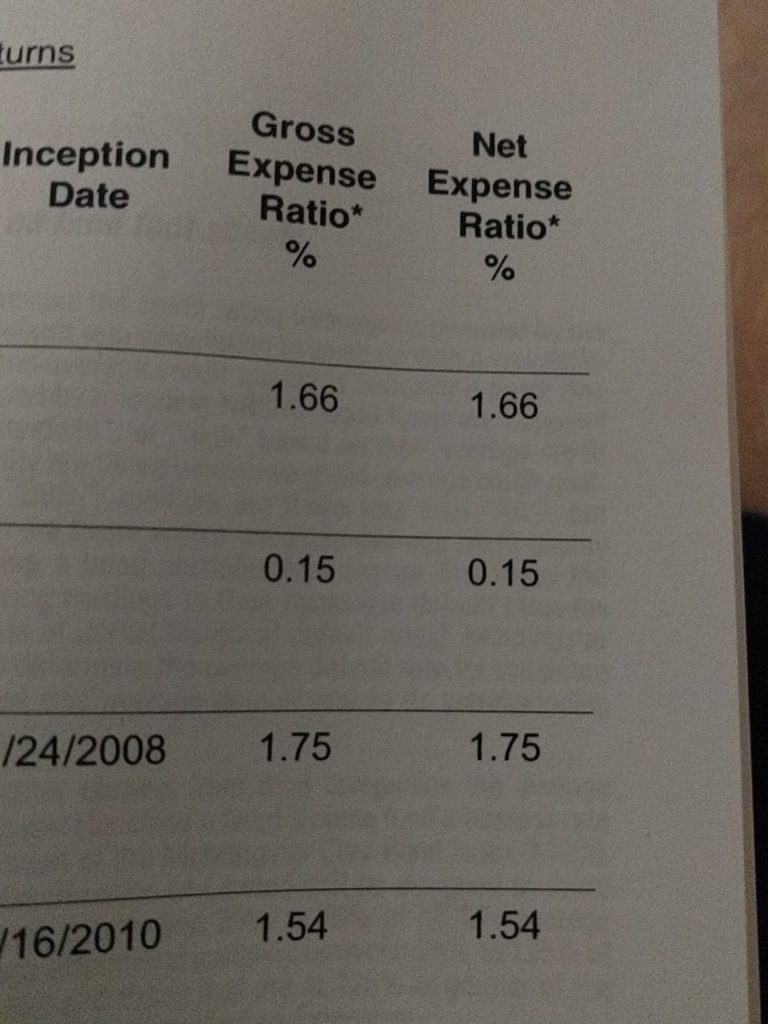

Russian 401(k) Roulette

Choose wisely! You only have a 25% chance of survival in this game.

It only seems proper to conclude with my favorite .GIF of all time: