Or, Alternatively, Fun with Pictures!

—

You’d never put something in your body before knowing what’s going in, right? Yet, similarly, why do investors sometimes spend huge portions of their precious savings into investment vehicles they know very little about? Simply put, the creativity of marketers has spread beyond the pharmacy.

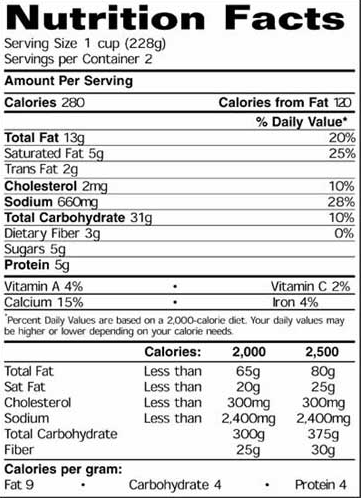

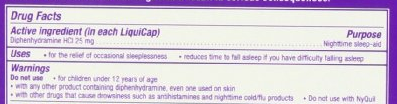

Just like any medication, it’s always wise to know exactly what’s going into your portfolio BEFORE you buy it. Have you heard of NyQuil’s latest miracle sleep aid, ZzzQuil? This achievement of modern medicine is no achievement at all – check out the labels to see why:

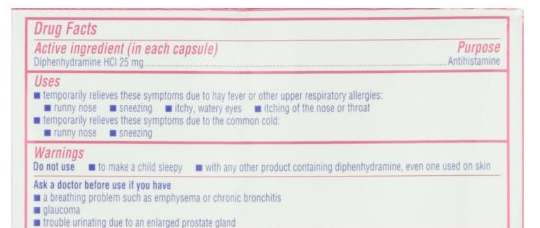

Non-habit forming – sounds good so far! But what’s in it?

Active ingredient: Diphenhydramine HCl 25mg. Sounds sophisticated enough to help me get to sleep, it must definitely be worth the price of 26 cents per Liquicap on Amazon.

But, wait – Diphenhydramine HCl 25mg sounds awfully similar to another product I’ve taken for my allergies. What was it called, though? Oh yeah – Benadryl! Let’s check the label on Benadryl.

Hmm: I’m seeing Diphenhydramine HCL again, there must be something else going on here, right? Maybe a different amount or added ingredients? Let’s check the back of the box! The industry can’t possibly think we as consumers are this stupid – I don’t believe that. They would not repackage products to charge a premium price, that would just be wrong. Let’s look at the back:

Diphenhydramine HCl 25mg! And guess what – it’s 16 cents per capsule on Amazon. Well, that’s pretty sneaky.

It gets even worse, as I’m sure you might have concluded by now. The generic version of ZzzQuil and Benadryl is MUCH cheaper. It can be had for 1.52 pennies per 25mg! That’s a 90% discount versus Benadryl.

In summary: the same exact product but it’s being packaged as something else with a premium price attached. So what’s the point?

The same exact process happens in the investing world and individual investors have been duped worse than those who buy ZzzQuil or Benadryl.

Why is it worse? Because various products are being packaged as something “special” or “premium” when in fact they are WORSE PERFORMING and MORE EXPENSIVE. In this case it’s not just that the same product is more expensive like Benadryl or ZzzQuil. An inferior product in the investing world is actually more expensive!

In other words: you pay more for less, instead of more for the same like with ZzzQuil. Let’s get back to the pictures.

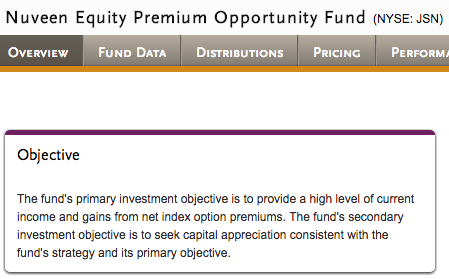

Here’s a Fancy Fund name with a fancy executive summary:

Translation: we’re going to engage in a risky strategy of selling options (the equivalent of picking up pennies in front of a steamroller) to hopefully produce income while we also make other bets with your money. Yikes.

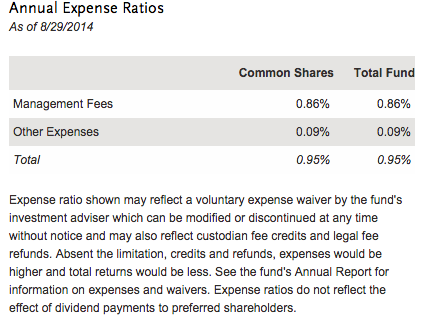

How much do they charge for this questionable strategy of capital management?

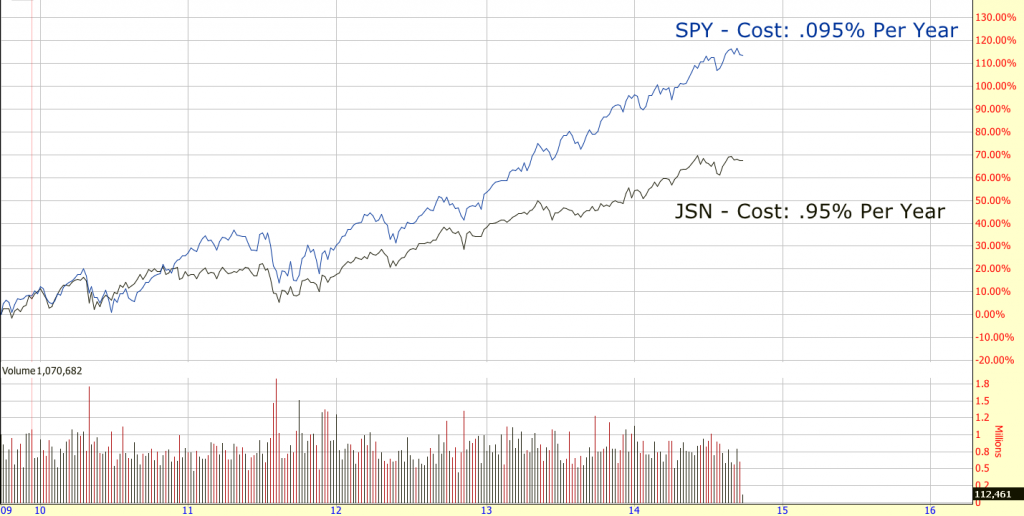

A more prudent investor might invest their capital into an inexpensive index fund like SPY. It would provide income via dividends and capital appreciation from the principal investment. “Income + Appreciation” sounds pretty comparable to the ultimate objectives of our fancy sounding “Equity Premium Opportunity Fund.” How do these two strategies compare? Let’s take a look:

That’s right – the “boring” option of investing with an index fund outperformed the Equity Premium Opportunity Fund by nearly 50% over the last five years. Here’s the kicker: the Fancy Fund is literally TEN TIMES more expensive than the passive index fund. Infuriating – worthy of popping some ZzzQuil, er, Benadryl, er, Diphenhydramine HCl 25mg.

The tactic prevails everywhere you look in the investing world. Outside of index funds, virtually every mutual fund, most closed end funds, SMAs and even some ETFs all exhibit the same strategy: a variation of a guy (or gal or guys and gals) at a desk trying to beat the market while charging you up to, or exceeding, a 1000% markup to effectively fail. And that’s not including any commissions or front-end sales charges.

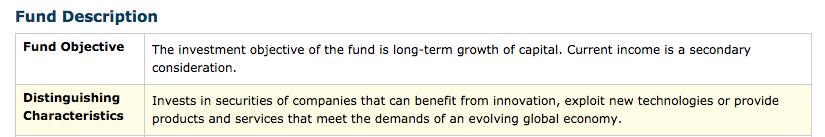

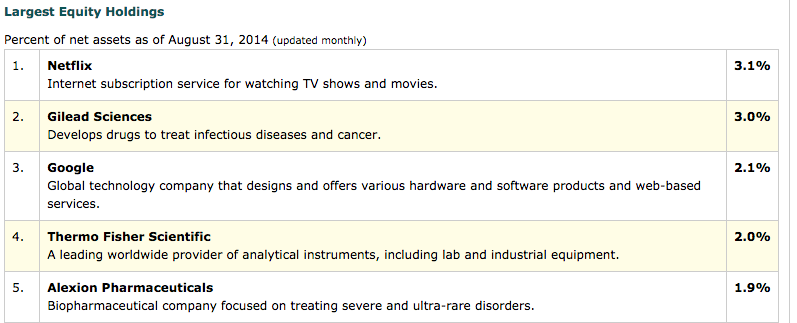

Here’s another special one: The New Economy Fund. Another very Fancy Fund name.

The New Economy Fund sounds awfully like a description for the NASDAQ stock exchange. They both consist of companies set to “benefit from innovation, exploit new technologies or provide products and services that meet the demands of an evolving global economy.”

The New Economy Fund Top 5 holdings of Netflix (tech), Gilead (biotech), Google (tech), Thermo Fisher (biotech) and Alexion (biotech) sure sounds like something close to the NASDAQ 100 Index.

Why, here’s the description of the NASDAQ 100 itself:

“The Index reflects companies across major industry groups including computer hardware and software, telecommunications, retail/wholesale trade and biotechnology.”

How does our Fancy Fund, The New Economy Fund, fare against the boring NASDAQ 100 index?

Up over 100% over five years is something to be proud of – except when compared to the much cheaper, and much better performing, option of investing directly with the boring index. The NASDAQ 100 index fund beat The New Economy Fund by over 50% over five years, all while including an expense ratio 75% lower than the Fancy Fund.

Underperformance persists across the universe of actively managed funds. It is a well-known fact that a majority of “guys-at-desks-trying-to-beat-the-market” fail to beat their benchmarks, while extracting exorbitant fees from (unfortunately) willing investors.

The charade of most actively managed funds is much like the sleight of hand we see with everyday consumer products. The unfortunate reality is that the prevailing deception is magnified when looking at the effect in the investing world versus small purchases at the pharmacy. The Fancy Fund phenomenon bilks funds from investors making the most important purchases of their lives – how they invest and prepare for the future.

The solution? Simple – remaining diversified in a portfolio of low-cost index funds.

When it comes to portfolio management, it matters very much whether or not investors are paying for generic.